More Recent Insights

Take a gander at a few of our most recent Insight articles. We cover so much more - so, click one and start learning now!

3 Part Series: Level Up Your Financial Literacy

Steps to Financial Stability After a LayoffFacing job loss can be overwhelming, but taking proactive steps can help you manage your finances and reduce stress. Discover how to evaluate your needs, wants, and debts to create a strategic plan that safeguards your financial future.

|

Money Talks: How Women Are Taking Charge of Their Finances Through Social MediaDiscover how candid conversations and the infotainment approach are empowering women to take control of their finances, driving a shift towards improved financial well-being and quality of life.

|

More Recent Insights

Take a gander at a few of our most recent Insight articles. We cover so much more - so, click one and start learning now!

3 Part Series: Level Up Your Financial Literacy

More Recent Insights

Take a gander at a few of our most recent Insight articles. We cover so much more - so, click one and start learning now!

3 Part Series: Level Up Your Financial Literacy

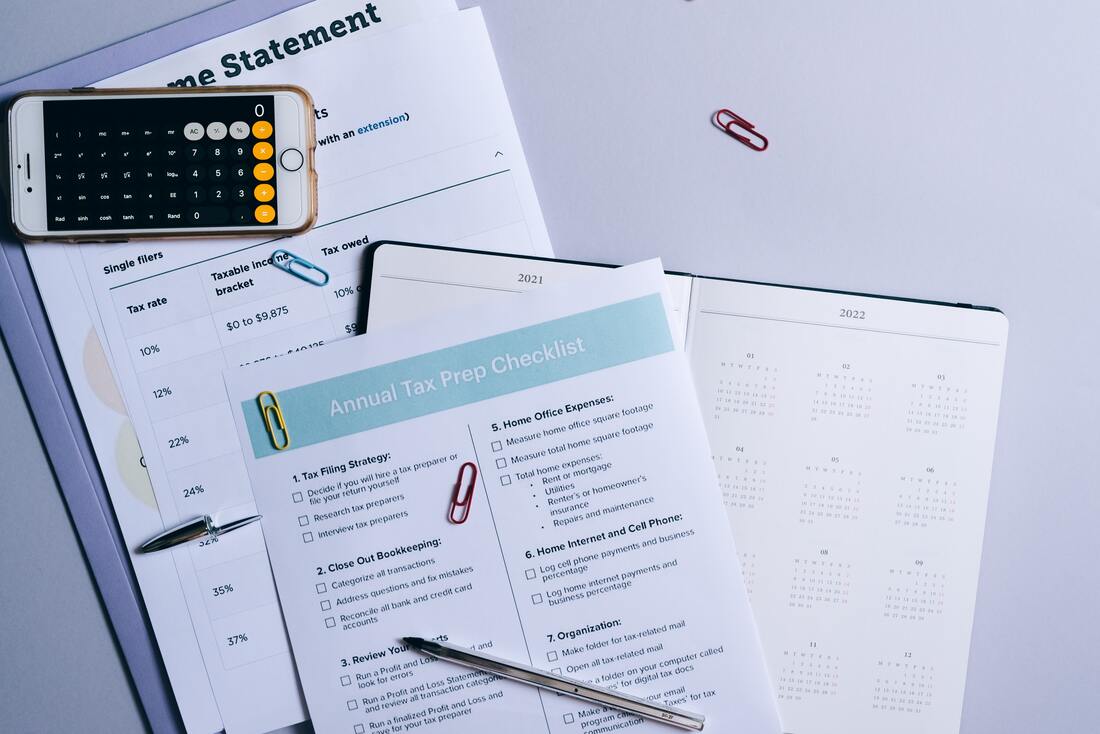

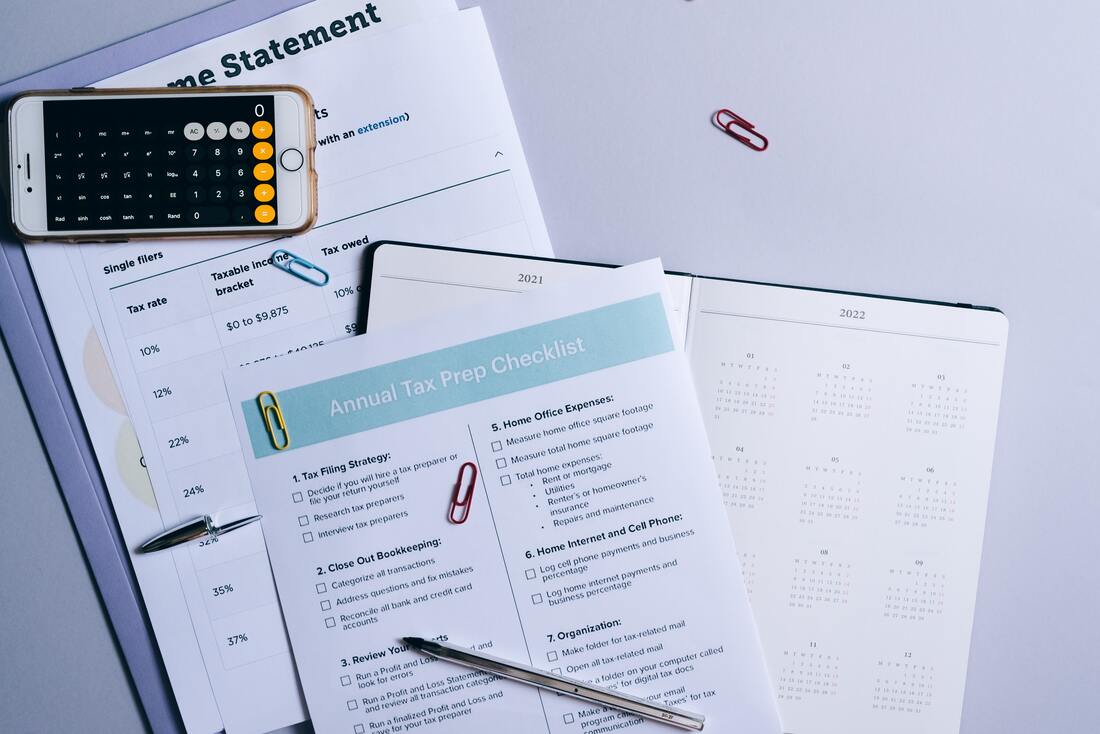

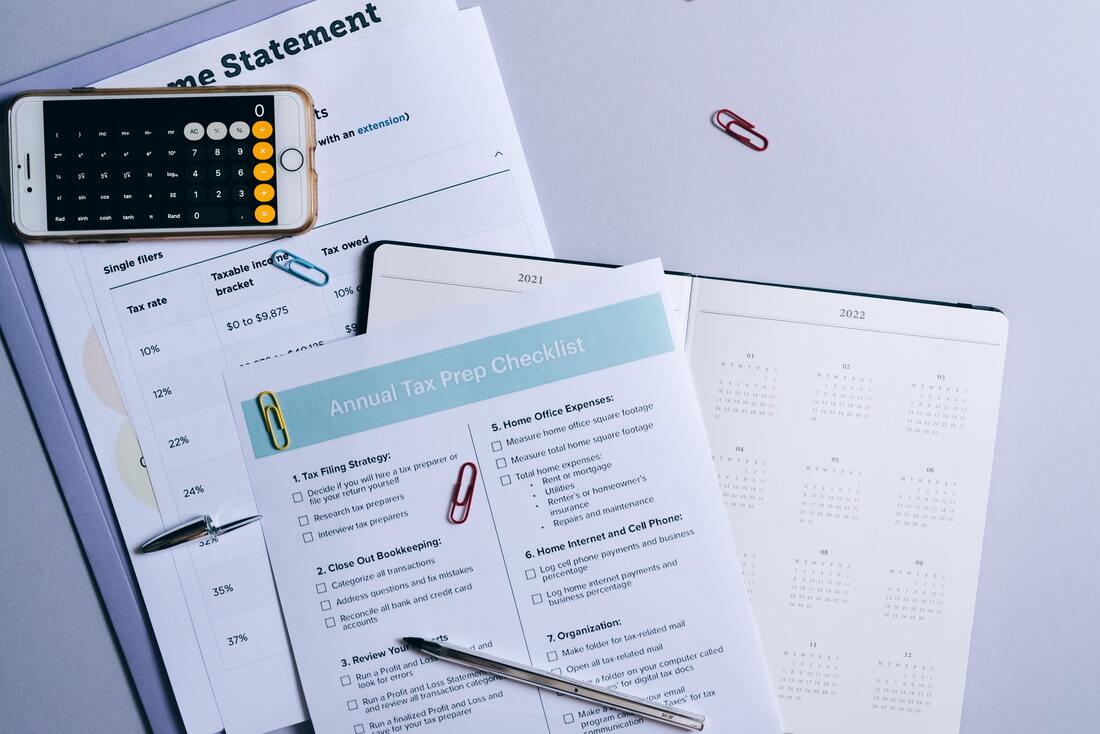

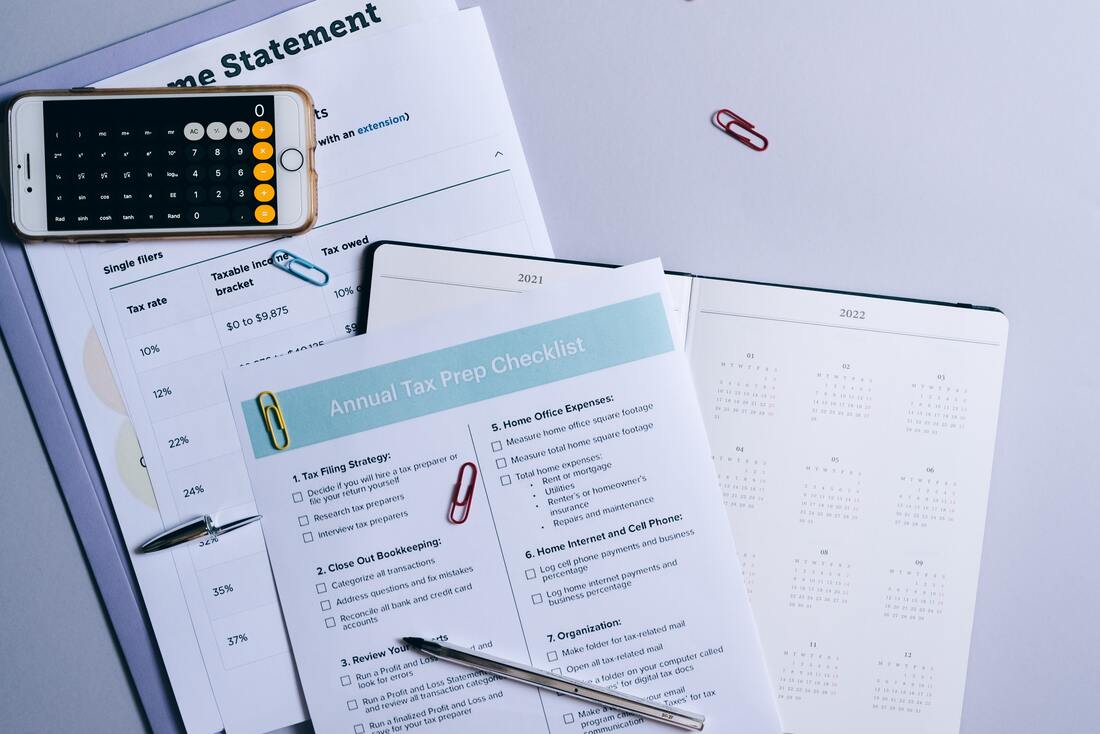

Should I Use My Tax Refund to Paydown Debt?Another tax year is here, and you've finally received a refund. Congratulations! Many people use this opportunity to pay down debt, but is it the right option for you? Take a moment to explore some options on how to spend or invest your tax refund.

|

More Recent Insights

Take a gander at a few of our most recent Insight articles. We cover so much more - so, click one and start learning now!

3 Part Series: Level Up Your Financial Literacy

The Dilemma of Diversification: Balancing Risk and Reward in InvestmentAs millennials, it's essential to rethink our investment strategies, considering diversification without sacrificing performance. Join us as we explore alternatives to traditional approaches and unlock the potential for a balanced and prosperous portfolio.

|

More Recent Insights

Take a gander at a few of our most recent Insight articles. We cover so much more - so, click one and start learning now!

3 Part Series: Level Up Your Financial Literacy

Master Your 401k: A Guide for Millennials and Gen ZUnlock the secrets to maximizing your 401k and avoid the pitfalls that leave Millennials and Gen Z at risk of investment failure. Discover how to break free from the limitations of target-date retirement funds, build a diverse portfolio tailored to your goals, and gain expert insights on navigating the ever-changing investment landscape. Don't miss out on the key strategies that could reshape your financial future!

|

Master Your 401k: A Guide for Millennials and Gen ZAs millennials, it's essential to rethink our investment strategies, considering diversification without sacrificing performance. Join us as we explore alternatives to traditional approaches and unlock the potential for a balanced and prosperous portfolio.

|

How to Save Like a “Rich” PersonWe look into exclusive strategies tailored for "rich" individuals (aka accredited investors). From optimizing liquid assets to exploring alternative investments, join us as we navigate the intricate landscape of wealth maximization, providing insights that go beyond conventional financial advice.

|

More Recent Insights

Take a gander at a few of our most recent Insight articles. We cover so much more - so, click one and start learning now!

3 Part Series: Level Up Your Financial Literacy

Master Your 401k: A Guide for Millennials and Gen ZUnlock the secrets to maximizing your 401k and avoid the pitfalls that leave Millennials and Gen Z at risk of investment failure. Discover how to break free from the limitations of target-date retirement funds, build a diverse portfolio tailored to your goals, and gain expert insights on navigating the ever-changing investment landscape. Don't miss out on the key strategies that could reshape your financial future!

|

More Recent Insights

Take a gander at a few of our most recent Insight articles. We cover so much more - so, click one and start learning now!

3 Part Series: Level Up Your Financial Literacy

Millennial Jet-Set: 5 Trips, Big Savings - Here's HowDiscover the Millennial travel revolution as they embark on an average of five trips annually, outshining peers in both frequency and savings. Uncover budgetary wisdom and accommodation strategies, proving that meaningful travel experiences can be affordable and enriching.

|

More Recent Insights

3 Part Series: Level Up Your Financial Literacy

Get In Touch With Us

Preparation

Create Your BudgetPrepare your budget using our complimentary worksheet.

|

Review Legal and Tax DocumentsDiscuss important legal and tax documents.

|

Evaluate Your InvestmentsCompile your existing investments by completing our Investment Analysis worksheet.

|

Retirement Planning

Retirement is an exciting phase of life, yet the planning process can sometimes feel overwhelming and intimidating for many. At Family Retirement, we strive to make the process feel like a cool breeze on a hot summer day.

There are many ways in which you can start preparing for retirement today. It's simple! First, think about some goals to help create a clear vision of what you're working towards. Next, take a moment to understand your finances by using our complimentary Budgeting Workbook.

Ultimately, the key is to start early, be consistent, and stay committed to your retirement goals. By taking these steps, you can transform retirement planning from a daunting task into a rewarding journey towards your dream retirement.

There are many ways in which you can start preparing for retirement today. It's simple! First, think about some goals to help create a clear vision of what you're working towards. Next, take a moment to understand your finances by using our complimentary Budgeting Workbook.

Ultimately, the key is to start early, be consistent, and stay committed to your retirement goals. By taking these steps, you can transform retirement planning from a daunting task into a rewarding journey towards your dream retirement.

"There is a whole new kind of life ahead, full of experiences just waiting to happen. Some call it 'retirement.' I call it bliss." –Betty Sullivan

|

September 2023

Decoding Term Life InsuranceThis article dives into the realm of term life insurance discussing the balance between cost concerns and adequate protection, and the potential pitfalls of quick-quote approaches. Take a moment to read our latest insight to learn more.

|

August 2023

Retirement Planning: A Family AffairRetirement planning is a family affair, with decisions impacting the future of both the individual and their loved ones. Effective communication, shared aspirations, and addressing longevity are only a few of key elements for successful execution. Take a moment to read our latest insight to learn more.

|

|

November 2023

Taxes and RetirementWe jump into the latest changes in tax brackets and bands, covering deductions and contribution limitations. Additionally, we present some strategic financial planning options for the upcoming year.

|

October 2023

The Great Wealth TransferWe highlight the importance of using trusts, ways to avoid probate, and how to utilize beneficiary statements and transfer on death instructions to safeguard the financial legacies you leave behind.

|

Insights

|

December 2023

Gifting in 2024: Tax Exclusions UnveiledEmbark on a journey into the intricacies of gift taxation in 2024 as we uncover the evolving limits with the Annual Gift Tax Exclusion and the significant uptick in the Lifetime Gift Exclusion. In this guide, we'll not only decode the numbers but also illuminate the path to crafting a tax-efficient strategy that ensures your generosity makes a meaningful impact.

|

Insights

|

January 2024

Millennial Jet-Set: 5 Trips, Big Savings - Here's HowDiscover the Millennial travel revolution as they embark on an average of five trips annually, outshining peers in both frequency and savings. Uncover budgetary wisdom and accommodation strategies, proving that meaningful travel experiences can be affordable and enriching.

|

|

December 2023

Gifting in 2024: Tax ExclusionsEmbark on a journey into the intricacies of gift taxation in 2024. In this guide, we'll not only decode the numbers but also illuminate the path to crafting a tax-efficient strategy that ensures your generosity makes a meaningful impact.

|

November 2023

Taxes and RetirementWe jump into the latest changes in tax brackets and bands, covering deductions and contribution limitations. Additionally, we present some strategic financial planning options for the upcoming year.

|

|

October 2023

The Great Wealth TransferWe highlight the importance of using trusts, ways to avoid probate, and how to utilize beneficiary statements and transfer on death instructions to safeguard the financial legacies you leave behind.

|

September 2023

Decoding Term Life InsuranceThis article dives into the realm of term life insurance discussing the balance between cost concerns and adequate protection, and the potential pitfalls of quick-quote approaches. Take a moment to read our latest insight to learn more.

|

August 2023

Retirement Planning: A Family AffairRetirement planning is a family affair, with decisions impacting the future of both the individual and their loved ones. Effective communication, shared aspirations, and addressing longevity are only a few of key elements for successful execution. Take a moment to read our latest insight to learn more.

|

Insights

|

December 2023

Gifting in 2024: Tax Exclusions UnveiledEmbark on a journey into the intricacies of gift taxation in 2024 as we uncover the evolving limits with the Annual Gift Tax Exclusion and the significant uptick in the Lifetime Gift Exclusion. In this guide, we'll not only decode the numbers but also illuminate the path to crafting a tax-efficient strategy that ensures your generosity makes a meaningful impact.

|

Insights

|

November 2023

2024 Financial Outlook:

|

Insights

|

November 2023

2024 Financial Outlook:

|

Insights

|

December 2023

Gifting in 2024: Tax Exclusions UnveiledEmbark on a journey into the intricacies of gift taxation in 2024 as we uncover the evolving limits with the Annual Gift Tax Exclusion and the significant uptick in the Lifetime Gift Exclusion. In this guide, we'll not only decode the numbers but also illuminate the path to crafting a tax-efficient strategy that ensures your generosity makes a meaningful impact.

|

|

September 2023

Decoding Term Life InsuranceThis article dives into the realm of term life insurance discussing the balance between cost concerns and adequate protection, and the potential pitfalls of quick-quote approaches. Take a moment to read our latest insight to learn more.

|

August 2023

Retirement Planning: A Family AffairRetirement planning is a family affair, with decisions impacting the future of both the individual and their loved ones. Effective communication, shared aspirations, and addressing longevity are only a few of key elements for successful execution. Take a moment to read our latest insight to learn more.

|

Insights

|

October 2023

The Great Wealth TransferIn 2023, the Federal Reserve disclosed that the U.S. held a staggering $140 trillion in generational wealth. This month we highlight the importance of using trusts, ways to avoid probate, and how to utilize beneficiary statements and transfer on death instructions to safeguard the financial legacies you leave behind.

|

Insights

|

November 2023

2024 Financial Outlook:

|

|

October 2023

The Great Wealth TransferWe highlight the importance of using trusts, ways to avoid probate, and how to utilize beneficiary statements and transfer on death instructions to safeguard the financial legacies you leave behind.

|

September 2023

Decoding Term Life InsuranceThis article dives into the realm of term life insurance discussing the balance between cost concerns and adequate protection, and the potential pitfalls of quick-quote approaches. Take a moment to read our latest insight to learn more.

|

August 2023

Retirement Planning: A Family AffairRetirement planning is a family affair, with decisions impacting the future of both the individual and their loved ones. Effective communication, shared aspirations, and addressing longevity are only a few of key elements for successful execution. Take a moment to read our latest insight to learn more.

|

|

May 2023

Women & InvestingWe take time to help you understand 3 habits women have when investing and how they may be leaving money on the table.

|

|

August 2023

Retirement Planning: A Family AffairRetirement planning is a family affair, with decisions impacting the future of both the individual and their loved ones. Effective communication, shared aspirations, and addressing longevity are only a few of key elements for successful execution. Take a moment to read our latest insight to learn more.

|

July 2023

Empowering LBGTQ+ Financial PlanningWe explore the complexities of retirement planning within this community, addressing the diverse considerations that arise, including family needs, elderly care, and legacy planning.

|

Insights

|

September 2023

Decoding Term Life Insurance: Coverage, Costs, and GuidanceThis month's article dives into the realm of term life insurance discussing the balance between cost concerns and adequate protection, and the potential pitfalls of quick-quote approaches. Take a moment to read our latest insight to learn more.

|

Insights

|

October 2023

The Great Wealth TransferIn 2023, the Federal Reserve disclosed that the U.S. held a staggering $140 trillion in generational wealth. This month we highlight the importance of using trusts, ways to avoid probate, and how to utilize beneficiary statements and transfer on death instructions to safeguard the financial legacies you leave behind.

|

|

September 2023

|

August 2023

|

|

This article dives into the realm of term life insurance discussing the balance between cost concerns and adequate protection, and the potential pitfalls of quick-quote approaches. Take a moment to read our latest insight to learn more.

|

Retirement planning is a family affair, with decisions impacting the future of both the individual and their loved ones. Effective communication, shared aspirations, and addressing longevity are only a few of key elements for successful execution. Take a moment to read our latest insight to learn more.

|

|

June 2023

Teaching Your Children About MoneyParents often ask, "what is the right way to teach my kids about money?" My best advice is by creating a mindset to set them up for success. Read more in this month's Insight on how my son discovered the value of his earnings.

|

|

May 2023

Women & InvestingWe take time to help you understand 3 habits women have when investing and how they may be leaving money on the table.

|

Insights

|

July 2023

Empowering LBGTQ+ Financial PlanningThis article explores the complexities of retirement planning within this community, addressing the diverse considerations that arise, including family needs, elderly care, and legacy planning. By shedding light on these aspects, we aim to provide insights on better preparation for the future and achieving financial security.

|

Insights

|

July 2023

Empowering LBGTQ+ Financial PlanningThis article explores the complexities of retirement planning within this community, addressing the diverse considerations that arise, including family needs, elderly care, and legacy planning. By shedding light on these aspects, we aim to provide insights on better preparation for the future and achieving financial security.

|

Insights

|

August 2023

Retirement Planning: A Family AffairRetirement planning is a family affair, with decisions impacting the future of both the individual and their loved ones. Effective communication, shared aspirations, and addressing longevity are only a few of key elements for successful execution. Take a moment to read our latest insight to learn more.

|

|

July 2023

Empowering LBGTQ+ Financial PlanningWe explore the complexities of retirement planning within this community, addressing the diverse considerations that arise, including family needs, elderly care, and legacy planning.

|

June 2023

Teaching Your Children About MoneyParents often ask, "what is the right way to teach my kids about money?" My best advice is by creating a mindset to set them up for success. Read more in this month's Insight on how my son discovered the value of his earnings.

|

May 2023

Women & InvestingWe take time to help you understand 3 habits women have when investing and how they may be leaving money on the table.

|

|

May 2023

Women & InvestingWe take time to help you understand 3 habits women have when investing and how they may be leaving money on the table.

|

Insights

|

June 2023

Teaching Your Children About MoneyParents often ask, "what is the right way to teach my kids about money?" My best advice is by creating a mindset to set them up for success. Read more in this month's Insight on how my son discovered the value of his earnings.

|

Insights

April 2023

Level Up Your Financial Literacy

We've shared the basics of financial literacy and now we want you to up your game. Learn more about tax liabilities and how it impacts your financial journey with our three-part series Better Than Basics: Level Up Your Financial Literacy.

Insights

April 2023

Level Up Your Financial Literacy

We've shared the basics of financial literacy and now we want you to up your game. Learn more about tax liabilities and how it impacts your financial journey with our series Better Than Basics: Level Up Your Financial Literacy.

|

February 2023

4 Steps to Take After a LayoffBeing laid off from your job is never easy and trying to figure out the next steps can be stressful. As we see more and more layoffs occur, we take a few moments to outline 4 simple steps to take after you're laid off.

|

January 2023

Financial Goals During a RecessionPreparation is key to any successful financial plan and while we aren't in a recession (yet), it is a good idea to get a plan in place. This month we kickoff the new year with some tips on how to reach your financial goals during a recession.

|

December 2022

Learn About Charitable GivingAs the holiday season kicks into gear, we take a moment to share a few items to check off your list before donating to your favorite charity.

|

Insights

|

April 2023

Level Up Your Financial Literacy: Part 1We've shared the basics of financial literacy and now we want you to up your game. Learn more about tax liabilities and how it impacts your financial journey with our three-part series Better Than Basics: Level Up Your Financial Literacy.

|

Insights

April 2023

Level Up Your Financial Literacy

We've shared the basics of financial literacy and now we want you to up your game. Learn more about tax liabilities and how it impacts your financial journey with our three-part series Better Than Basics: Level Up Your Financial Literacy.

|

November 2022

3 Things to Do in a RecessionYou've seen it all over the news and now we must face the facts. As more indicators point to a recession, we outline 3 simple changes you can make today to prepare.

|

September 2022

3 Common Types of Life InsuranceSeptember is Life Insurance Awareness month and we take time to review 3 common types of insurance and how you can benefit by adding one of them to your financial plan.

|

July 2022

Questions To Ask Before Getting MarriedIt's wedding season and after 2 years of waiting through COVID, your big day is finally here! But, before you say your "I do's", we have one more item to add to your checklist. Take some time with your partner to discuss these 3 questions.

|

Latest Media

|

March 2022

Tax Planning in RetirementLearn about three common account types, how they are taxed, and what you can do to reduce your taxes in retirement.

|

January 2022

Put Your Debt Into PerspectiveGet motivated to pay off high interest debt after we share how much you are really spending.

|

Mission

Together we'll inspire preparation for each life phase through educational classes, personalized services, financial product recommendations, and expertise focused on your financial prosperity. Just as conserving your family legacy is your first priority, our commitment to fiduciary responsibility is ingrained.

Limited Time OnlyWe offer classes to help you learn about investing with your Health Savings Account (HSA).

|