|

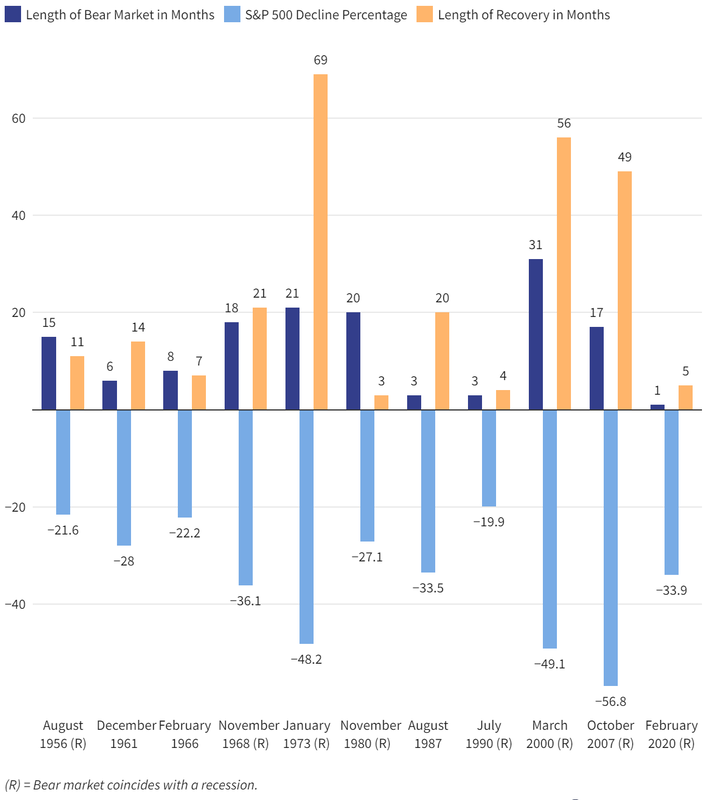

When investors rebalance their portfolios, the influence of their decisions is usually determined by media outlet research. If you’ve been listening to most news sources then you are hearing recession, recession, recession. But, if you are looking at the data and trying to find a way back into the market: here are some tips you’ll want to review. When do you know it’s the bottom? Many people associate a bear market with a recession. A recession is typically defined as 2 consecutive quarters of negative gross domestic product (GDP). However, a bear market is a drop from the peak to the bottom of greater than 20%. Our peak was December of 2021 (S&P 4766.18) and our most recent bottom is October of 2022 (S&P 3583.07). While this may not be the bottom, an average bear market is 9-13 months. Since our recent low, markets have been bouncing around influenced by the latest interest rate increases and other economic data point decreases. S&P 500 Bear Markets and Recoveries How can you invest? After you’ve evaluated where the market stands you can move in two different directions. The first is the path to recovery and the other is expansion. The path to recovery means we may have some turbulent times ahead but investing in sectors that have lower beta than the S&P should limit the drawdown your portfolio is exposed to. Common investment sectors include utilities, consumer staples, healthcare, and real estate. Keep in mind, this strategy doesn’t guarantee against loss but it creates an inverse reaction to the general stock market. If you are under the impression that we are likely to move towards expansion, you’ll be looking for options that have a higher beta than the S&P (e.g., greater than 1.0). These are not guaranteed to produce a gain and are subject to more volatility. Sectors you’ll commonly see aligned with those portfolios are energy, consumer discretionary, financial, and technology. Stepping away from sector focused investing another traditional train of thought is to move more money into bonds but with the rising interest rates. Though, it might be best to table that for a little while. You’ll also notice that the best performing indices might not be the Dow or S&P, and in many cases have been NASDAQ and Russell. Having the right balance between market knowledge and understanding your investment style is imperative to making sure your portfolio is meeting your goals. Book your appointment below and take the first step to put a plan in place. If you fail to plan, you plan to fail.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

Financial Services are offered through Family Retirement LLC, a registered investment advisor. Family Retirement LLC is a registered investment advisor in the State of Washington. Family Retirement LLC may not transact business in states where we are not appropriately registered, excluded, or exempted from registration. Individual responses to persons that involve either the effecting of transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions.

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

RSS Feed

RSS Feed