|

Nowadays, women and investing is becoming a hotter topic. Sites like Dow Janes and Ellevest target their marketing towards women as their investing needs and goals for retirement do not conform to the traditional path. For example, I’ve seen men do some of the riskiest things with their lives and those habits inevitably lead to shorter longevity. Therefore, women often focus more on longevity since they tend to outlive men. While evaluating their portfolios, women will want to pay attention to these three behaviors to avoid letting returns slip away. Lower Contributions In Vanguard's, How American Saves Study, it shows that women participate in their 401k contributions more than their male counterparts; however, they are saving at a lower rate. Oftentimes these savings rates increase as the women become higher income earners. Some other factors for lower contributions and account balances involve women entering the workforce later in life and women often start at the entry level positions and work their way up. Between the lower rate of savings and the wage gap - currently 82 cents per every dollar a man earns - it’s even harder for women to save for a lengthy retirement. Lower Risk Tolerance Men and women differ in many ways when it comes to their risk tolerance. For instance, men take more risk when investing. To determine your risk tolerance, complete an investor profile. An investor profile is based on several different factors: risk tolerance, financial goals, and time horizon. Time horizon is arguably one of the most important factors to creating your investor profile. If this is a roadmap to retirement, think of the time horizon as the destination and the speed is your risk tolerance. Another consideration when analyzing the lower risk tolerance of women is evaluating the downside potential. Many investors focus on how much they can make and the potential loss. Since women make less on average, the thought of losing their hard earned money is not worth the high risk. Analysis Paralysis Let’s assume you are able to contribute at a greater rate and you have a higher risk tolerance. Then the only thing standing in the way is research and execution. Research is not much of an issue for female investors, the concern is execution. Execution can be stunted in a variety of ways: trying to time the market, imposter syndrome, or they are just plain too busy. Unfortunately, these three behaviors create a trifecta for lower returns and most women are repeat offenders. It’s not with malicious intent that women do it but instead it’s from natural programming with the instinct to protect. This protection resonates differently amongst women but it starts with their association with money. To take a closer look at that, sit down with me and make your investments a priority. If you fail to plan, you plan to fail.

0 Comments

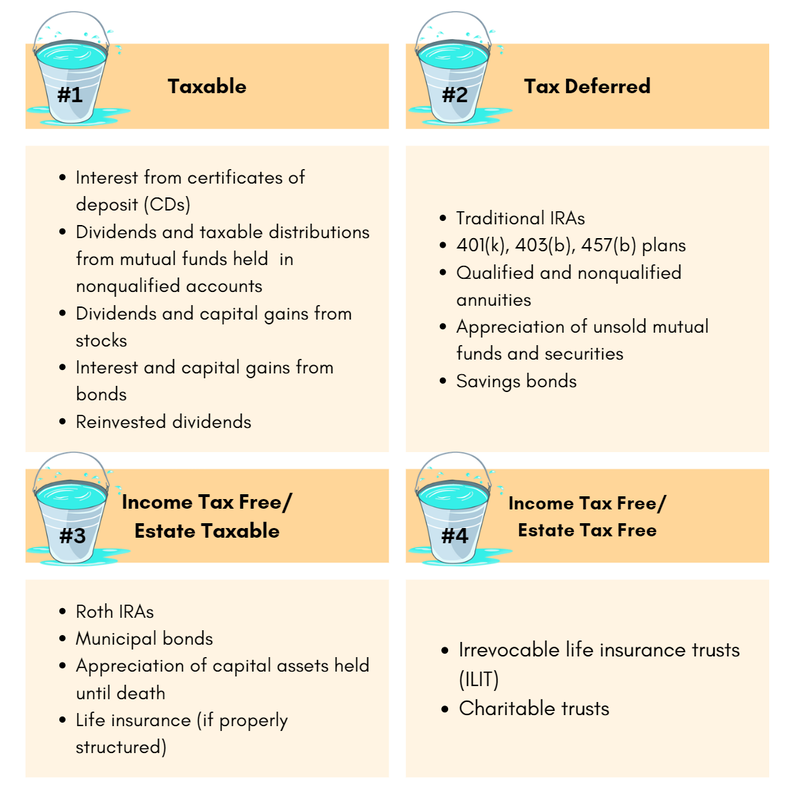

Over the past few weeks you can take what we’ve learned and compare it against your career path. Part one of our series focuses on individuals just starting their first jobs and are overwhelmed with the constant inflow of information. Part two is when you’ve had a couple of years to digest the information and want to invest more productively. The last and third part of our series is aimed toward those individuals who are ready to start withdrawing from these accounts. As we explained in part two, tax liabilities for each account varies and withdrawing from them can negatively impact your tax situation. For example, some investors will withdraw funds from their brokerage account to make larger purchases (i.e., home, car, etc.) but if the investments are held less than 12 months there are tax implications. Even more, if you are looking to pull money from a retirement account the amount is restricted and is only for first-time homebuyers - this is unless you are willing to take an additional penalty on top of the ordinary income. The Bucket System One traditional method for withdrawing money is called the bucket system. This strategy is based on the philosophy that over time you’ll receive more income as you age and this is partly due to earnings from social security and required minimum distributions. This system breaks up account types into taxable, tax deferred, and tax free. Each of these tax liabilities were discussed in Part two of our series. Most investors will begin withdrawing from Bucket 1: Taxable accounts to subsidize their income as they age. After depleting the funds from Bucket 1, you’ll ideally move to Bucket 2: Tax Deferred withdrawals. In some cases - like required minimum distributions (RMD) - you would need to take a distribution prior to the depletion of your taxable funds (e.g., bucket 1). After that point, you can offset your RMD and reduce the amount taken from Bucket 1. If you have disbursed everything from your first and second bucket, you’ll move on to the Bucket 3:Tax Free which will have the most favorable tax treatment. In the example below, you will see there is a fourth bucket which is specific to reducing your estate’s taxable liability after you’ve passed. We haven’t discussed much about this but in our life insurance series later this year we’ll dive into this strategy. This system is not fool proof and depending on your financial situation a second opinion can save you money that others would have left on the table. I work with individuals to help create plans around their financial goals and offer guidance on how to take advantage of the opportunities within their portfolio. For a personalized plan, schedule an appointment with me today and to learn more about Strategies for Retirement use the download button below for a FREE pamphlet. If you fail to plan, you plan to fail.

|

Archives

July 2024

Categories |

Financial Services are offered through Family Retirement LLC, a registered investment advisor. Family Retirement LLC is a registered investment advisor in the State of Washington. Family Retirement LLC may not transact business in states where we are not appropriately registered, excluded, or exempted from registration. Individual responses to persons that involve either the effecting of transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions.

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

RSS Feed

RSS Feed