|

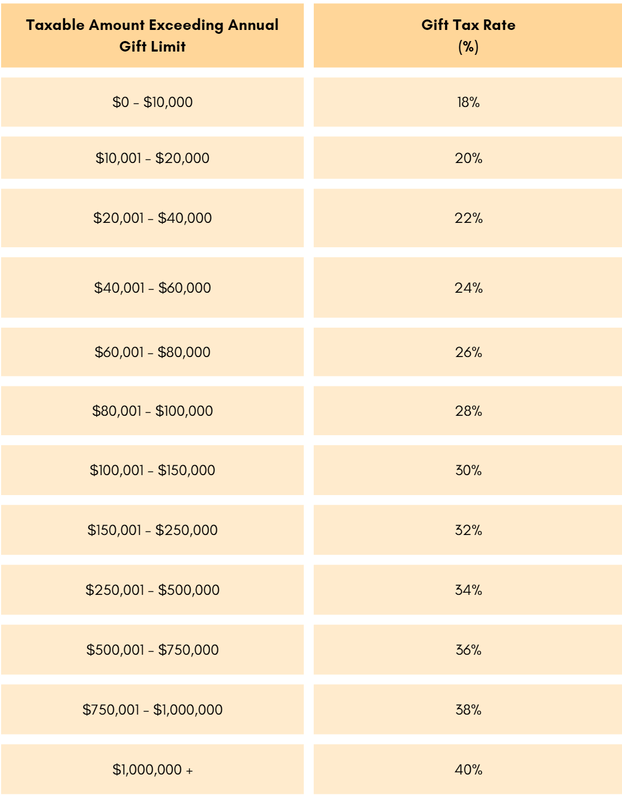

Every December, I make it a point to discuss matters related to charitable giving and gifting, and this year is no different. While there are numerous opportunities to contribute, it's crucial to consider tax efficiency, especially given the adjustments to the Annual Gift Tax Exclusion and Lifetime Gift Exclusion. Before exploring the specifics of these increases, let's first clarify the distinction between the Annual Gift Tax Exclusion and the Lifetime Gift Exclusion. The Annual Gift Tax sets the threshold for how much you can give before needing to complete Form 709. Any excess beyond this limit falls into the Lifetime Gift Exclusion, representing the maximum amount you can give before reporting the federal gift tax. It's important to note that the donor is responsible for paying the tax, and typically, these contributions are not tax-deductible unless they are charitable. Once the lifetime gift exclusion is exhausted, the federal tax on additional gifts may range from 18% to 40% if the contributions exceed the annual limit per donee. It's like navigating a gift-giving journey with a few tax signposts along the way! Federal Gift Tax Rates In 2023, the Annual Gift Tax Exclusion stood at $17,000 per donee, and next year, in 2024, it will see a bump to $18,000 per donee. Meanwhile, the Lifetime Gift Exclusion, which was $12.92 million in 2023, is set to rise to $13.61 million in 2024. Staying informed about these figures is crucial, but navigating the complex landscape of gift taxation demands the expertise of a professional tax advisor, especially considering the potential expiration of the lifetime gift exclusion post-2025 due to temporary changes in the Tax Cuts and Jobs Act 2017. It's worth noting that gifts take various forms, and only direct transfers to your spouse, medical providers, tuition/education, and gifts to political organizations qualify as exclusions. Crafting the optimal tax strategy for your giving requires careful planning, as we always say, if you fail to plan, you plan to fail. References

0 Comments

|

Archives

July 2024

Categories |

Financial Services are offered through Family Retirement LLC, a registered investment advisor. Family Retirement LLC is a registered investment advisor in the State of Washington. Family Retirement LLC may not transact business in states where we are not appropriately registered, excluded, or exempted from registration. Individual responses to persons that involve either the effecting of transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions.

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

RSS Feed

RSS Feed