|

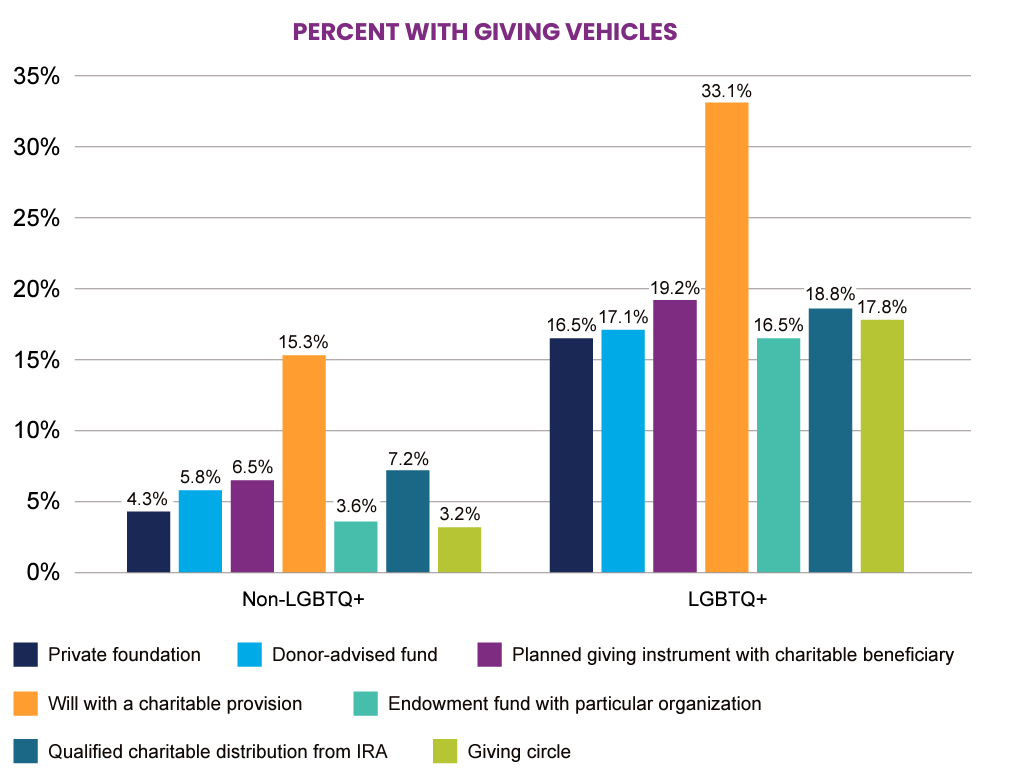

In the vibrant tapestry of human diversity, the LGBTQ+ community stands as a beacon of resilience, courage, and pride. As this community continues to strive for equal rights and recognition, it is crucial to shed light on the unique financial challenges they face. From wage gaps and employment discrimination to the complex intricacies of family planning and retirement, the financial landscape for queer individuals demands attention and understanding. This article delves into some of the unique considerations in retirement planning and how to better prepare for the future. Family Needs Yes, everyone has different needs but when you are a member of the LGBTQ+ community the journey towards expanding your family entails heightened financial obligations from the outset. When you evaluate the available options: in vitro fertilization (IVF), surrogacy, or adoption, the cost associated can be well over $60,000. Expanding your family comes with not only financial implications but also emotional ramifications. Families opting for adoption often experience prolonged periods of emotional turbulence and uncertainty in their journey with the child they have welcomed into their lives, enduring months or even years of back-and-forth interactions. Understanding the best options for withdrawals could save you from paying undue taxes. Elderly Care When considering long-term care alternatives, the challenges encountered by LGBTQ+ individuals extend beyond the fundamental facility requirements. Some factors of consideration include ensuring the facility and caretakers have aligned values, as well as meeting their financial limitations. Historically, the LGBTQ+ community has been impacted by HIV and AIDS. While treatment advances have come a long way, immunocompromised individuals are more likely to require home care. The LBGTQ+ community is 2-3 times more likely to live independently due to the premium cost of specialized care. Legacy Planning In a 2021 Bank of America Philanthropy Study: Charitable Giving by Affluent Households, affluent LGBTQ+ households were more likely to contain multiple different charitable vehicles and give at a higher rate than their non-LGBTQ+ households. The variety of vehicles used for their charitable organization are intentional through the utilization of donor advised funds and charitable distributions from an IRA. When a legacy plan is carefully curated it is mutually beneficial to the owner and charity. Affluent LGBTQ+ Americans Prioritize Making an Impact Source: Bank of America. “2021 Bank of America Study of Philanthropy: Charitable Giving by Affluent Households.” September 29, 2021 Beyond the glittering surface of progress, many members of the LGBTQ+ community encounter formidable financial hurdles that impact their livelihoods and long-term stability. We want to help smooth these barriers out. When looking for a financial advisor, on top of all the other qualifications, you want to make sure that the individual honors pronouns, doesn’t lump you into the group of their clients, and provides you with the comfort of a plan best suited for your needs and journey. Book an appointment below to see if we are the right fit for you. Resources

0 Comments

|

Archives

July 2024

Categories |

Financial Services are offered through Family Retirement LLC, a registered investment advisor. Family Retirement LLC is a registered investment advisor in the State of Washington. Family Retirement LLC may not transact business in states where we are not appropriately registered, excluded, or exempted from registration. Individual responses to persons that involve either the effecting of transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions.

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

RSS Feed

RSS Feed