|

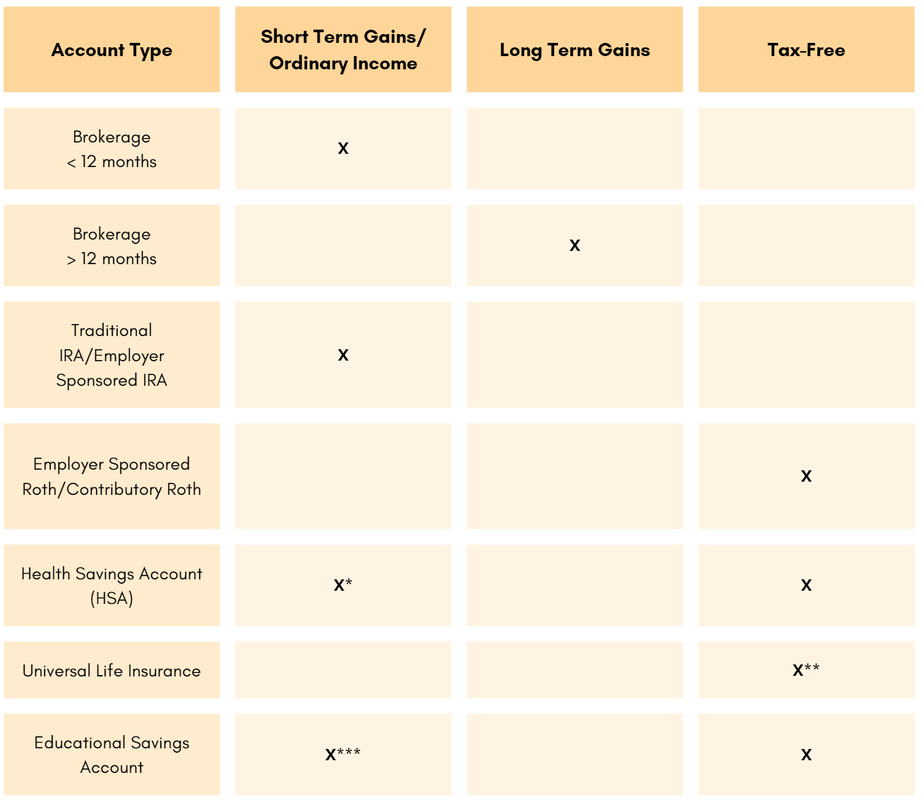

In Part One of our series, we discussed how knowing the basics of financial literacy is helpful but it’s not enough. Oftentimes the losses are simple misunderstandings about the taxation of different investing accounts. To start leveling up your literacy, we associated some common account types and their typical tax classifications. Now, it’s time to kick it up a notch! In Part Two, you’ll learn about short versus long term gains, ordinary income tax rates, and calculating profit. Short Term Capital Gains /(Ordinary Income Tax Rate) Simply put, short term capital gains are the profit on an investment that is held for less than 12 months. These gains are taxed at the same rate as your ordinary income. Your ordinary income rate is based on your filing status and your taxable income. It’s important to know that tax brackets are established annually and marginal - this means that rates change annually and the marginal tax rate is tiered. Long Term Capital Gains Long term capital gains are the profit on an investment that has been held for 12 months or longer. The taxation on the profit is broken down into three tiers based on your filing status and federal income. These tiers will change annually depending on taxable income. Non-Taxable or Tax-Free Out of the three taxation methods, this type is my favorite because the profits and the income from these funds are not subject to taxation. However, there are also many scenarios where you can lose tax free status. So, make sure to consult a tax professional before making updates in your account and to help you get a better understanding of those restrictions. Calculating Profit Since you have a good understanding of taxation methods, let’s take a few seconds to create the profit calculation. Profit is the difference between the purchase price and the sell price. The purchase price can be found on your investment statements and is called “cost basis”. Subtract the purchase price from the selling price to get your profit. Calculating Capital Gains Taxation will depend on 2 factors: current tax rate and type of gain short/long. If it’s short, you add your ordinary income and be taxed at the end of year income. If it’s long you need to find your tax rate and then the corresponding long term capital gains rate. The profit will be taxed at that rate. You may notice that only brokerage accounts track this because they are not tax advantaged - unlike your retirement accounts. As we wrap up this series, I want to reiterate the different tax triggers for each account. Brokerage accounts are triggered by the sales of positions in the portfolio and not by a withdrawal from your account. Pre-tax retirement accounts are always taxed at the ordinary income rates. Lastly, Roth accounts are tax-free assuming no restrictions apply. Remember to discuss these decisions with a tax professional. Having a better understanding of taxation rates for accounts leads perfectly into our next topic. We'll conclude this series by learning to properly structure withdrawal from these account types to limit your tax liability and improve your financial outlook. If you fail to plan, you plan to fail.

0 Comments

Becoming familiar with the basics of financial literacy - budgeting, investing, and personal finance - helps most Americans create plans to achieve their financial goals. However, financial literacy goes beyond the basics. In fact, a 2020 survey found that the majority of surveyors lost approximately $1600 due to lack of understanding - in the U.S that’s a loss of over 415 billion dollars. So it begs the question, how do investors stop leaving money on the table? If you’ve already laid the foundation with the basics, the next big opportunity is within your tax liabilities. Tax liabilities are simply the taxes you will pay to the government though our focus is taxes that occur while investing. More specifically, we take time to review taxation on various account types, the “gold standard” for withdrawing funds, and how/when penalties are triggered. Account Review To understand different tax liabilities, the first thing we review is account type. Each investment account has distinct tax liabilities which are in the form of short and long term capital gains, ordinary income, and tax-free. The amount taxed will depend on the account type, investment time frame, and income, as well as some other factors. Below are some common account types and typical taxation methods. *When funds are used for non-medical expenses under age 65 and 20% additional penalty. **When taken as a loan. ***Non-qualified and 10% penalty. As you can see, the chart is not as straightforward as it seems. There are exceptions and instances where you can find yourself with higher tax liabilities for failure to understand the restrictions. There are even cases where accounts can lose their tax advantaged status. Each situation is unique and there isn’t a “one size fits all” solution. If you need some assistance or want to learn more, simply schedule a meeting using the link below. Be on the lookout for Part 2, where we’ll break down taxation rates and review consequences. In the final part 3 of our series, we’ll wrap up on when to take money out of each account to minimize your tax liability. If you fail to plan, you plan to fail.

|

Archives

July 2024

Categories |

Financial Services are offered through Family Retirement LLC, a registered investment advisor. Family Retirement LLC is a registered investment advisor in the State of Washington. Family Retirement LLC may not transact business in states where we are not appropriately registered, excluded, or exempted from registration. Individual responses to persons that involve either the effecting of transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions.

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

RSS Feed

RSS Feed