|

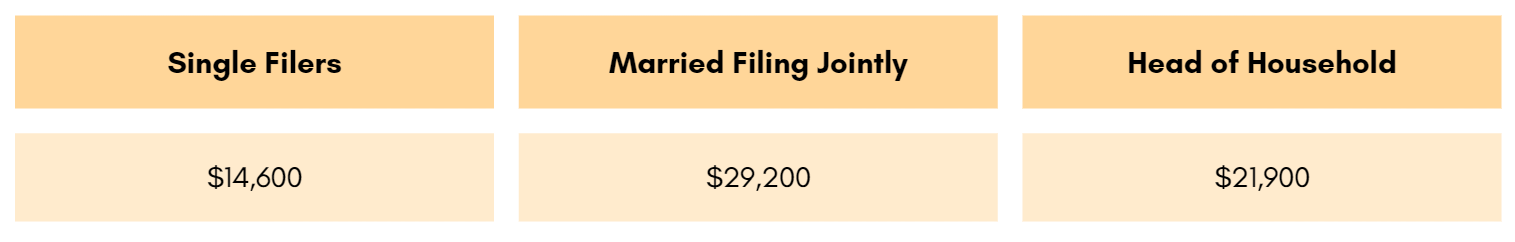

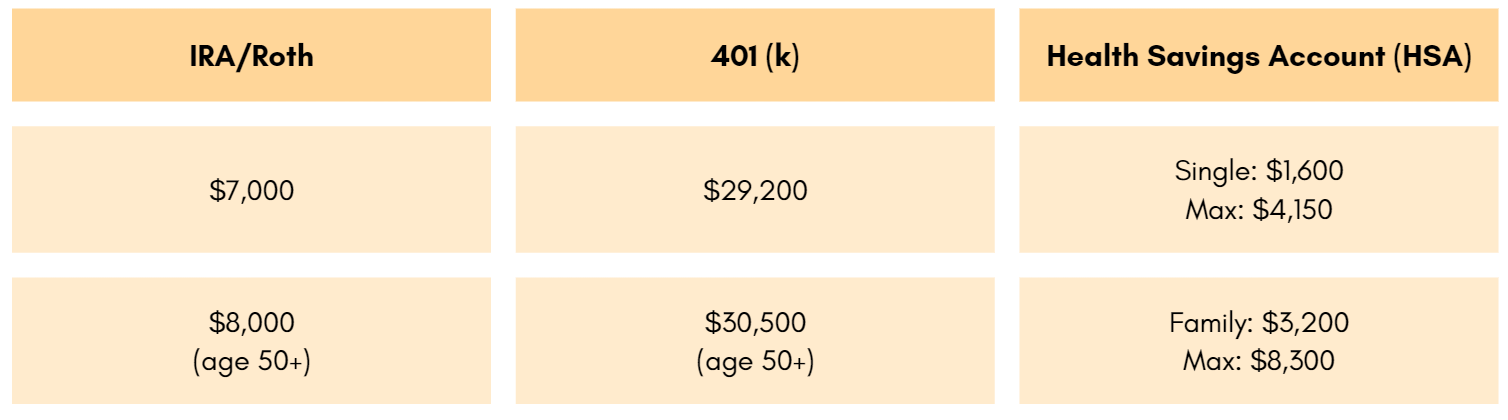

In October of each year, taxpayers typically anticipate the release of the IRS tax bands for each bracket. However, this year, the eagerly awaited information was not released until November 9th. It's crucial to distinguish between brackets and bands, with the former being a result of the 2017 Tax Cuts and Jobs Act. The current brackets stand at 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Notably, these brackets are slated to expire at the close of 2025, at which point the previous tax brackets are expected to take effect, with rates of 10%, 15%, 25%, 28%, 33%, 35%, and 39.7%, unless congressional intervention occurs. Unlike brackets, tax bands undergo annual adjustments to account for inflation and reflect changes in income for the respective year. Now, let's review some of the modifications currently in place. Deductions Every filing status comes with a standard deduction, complemented by additional deductions available for use in the upcoming tax year. For the current year, the inflation adjustments affecting the standard deduction and annual gifts are outlined below. As you can see, the annual exclusion for gifts is set to rise to $18,000 for the calendar year 2024. Contribution Limitations Leveraging retirement contributions presents a valuable opportunity to minimize your taxable liabilities, provided you meet the qualifying criteria. Notice the recent adjustments to IRA/Roth phase-out limits, now set at $123,000 to $143,000 for those filing jointly, and $77,000 to $87,000 for single filers. Strategically allocating funds towards retirement savings, coupled with a committed adherence to a budget, stands out as a strong approach to securing your financial success. Takeaways

Ensuring effective planning is key as you approach the upcoming year and here are some important takeaways:

In an ideal scenario, especially for those aged 50 and above with a family high-deductible health plan featuring a Health Savings Account (HSA), there's an opportunity to contribute up to $46,800 and potentially adjust your marginal tax rate by 10%. It's crucial to consult with a tax advisor to tailor a plan to your unique circumstances. These insights serve as tools for your discussions with them. Keep in mind, these approaches and methods are only a few ways in which I help families grow their savings. Collaborating with professionals ensures that your goals remain aligned and provides a comprehensive strategy for your financial success.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

Financial Services are offered through Family Retirement LLC, a registered investment advisor. Family Retirement LLC is a registered investment advisor in the State of Washington. Family Retirement LLC may not transact business in states where we are not appropriately registered, excluded, or exempted from registration. Individual responses to persons that involve either the effecting of transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions.

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

RSS Feed

RSS Feed