|

In the spirit of celebrating United States Independence, let’s find out what it really takes to be financially independent and retire early. At face value, anyone could retire at any age if their spending aligns with their cash flow. However, as you know, life has many variables. We’ll identify the most common variables and put together a plan to achieve financial independence. Before we establish the potential variables, we need to create a current working model: your budget. You should list all of your expenses and categorize them accordingly. I also like to break them down into Needs, Wants, and Savings. You can use my monthly budget workbook to help you. Next, we will establish financial goals. When you retire, what will you want to do? Travel, invest in a business, move, or buy a new car? If so, how often will you want to do these things? Assign a cost to each of these goals and apply an inflation factor based on how many years it will take to achieve them. The standard inflation rate is set at 3%, but I like to use the SSA COLA table. If you plan on being retired for 40+ years, this will provide historical input that is helpful for your planning process. You will divide each goal by the number of years it takes to achieve them, then add that to your annual spending to give you a more realistic picture of your life in retirement.

That annual figure will be what you need to live on. Multiply that by 25 years, and that is what you will want to have for retirement. I recommend having 2 years of expenses in cash to stabilize your income stream. By "cash," I mean placing it in a high-yield account. This way, it will produce interest along the way. Another advantage of this strategy is that you will not have to withdraw from your accounts during a market downturn. Withdrawing during a market downturn will take longer to recover. Other considerations include the types of accounts you are using to retire early and whether these accounts will generate a regular rate of return to maintain your lifestyle. Contributions to retirement accounts will not be accessible before the age of 59 ½ without a penalty. Additionally, if you have entered retirement and your risk tolerance has changed, you may not have the growth needed to support an early retirement. If you have any questions along the way, I’m here to help and support you in an exciting journey to start living your life on your terms.

0 Comments

Being the sole or primary source of income comes with stresses that are exacerbated during volatile times. Layoffs are a major source of stress, particularly in the tech industry, where they seem to be common. There’s even a website, Layoffs.fyi, dedicated to tracking the latest news about layoffs and trends over the years. While you can't control layoffs, the stress they cause can impact your decision-making process.

When you fear losing your job, financial practicality often goes out the window. To set yourself up for success, you must evaluate your needs, wants, and debts. Then, create a strategic plan to address them, along with a timeline for when you may no longer be able to meet them. Needs are essentials for your family, such as housing, utilities, and food. You should have a budget for these categories to determine if your unemployment benefits will cover them. If not, and you have an FHA-insured loan, you can request a forbearance by contacting your mortgage provider to see what options are available. It's important to do this before you fall behind on payments. Wants, like vacations, should be reconsidered during unemployment. If a vacation isn't fully paid for in advance, it’s not in your best interest to proceed. Additionally, time away from the job hunt can be more stressful than relaxing. Addressing credit cards, student loans, and auto loans should be a priority once you find out about your job loss. Federal student loans offer income-driven repayment plans, where payments are based on your income. Auto loans, like mortgages, may have options for deferral during financial hardships. For credit cards, if you are only paying the minimum amount, it might be best to speak with a representative to set up a payment plan, typically with a lower interest rate and fixed payments. Many people try to withdraw from their retirement accounts, but this creates a short-term solution for a long-term problem. Additionally, improper use of these funds can result in significant tax repercussions. If you’ve recently been laid off and need guidance, reach out to me so we can keep your life on track. Reference 1. Layoffs.fyi Year over year, the influence of women investing early and often has increased. This year, Gen Z is set to outpace the savings rates of all generations at this point in their lives. Additionally, they are more bullish about the market and believe their financial situation warrants a conversation with a financial advisor. What is fueling this change from other generations? Social media.

“Finfluencers” like Vivian Tu @YourRichBFF engage their audience with the allure of financial vitality through various social platforms and podcasts. Unlike traditional lectures on compounding interest and buy-and-hold strategies, this approach allows new audiences to be engaged through infotainment scrolling. Unknowingly, like-minded information is populating your feed, passively educating the masses. Women are drawn to Finfluencers because they are not tied to a pedigree; it's about the content provided. Candid conversations about money and the impact on personal stories carry weight to ignite change. Women don’t want to be the cautionary tale. Furthermore, women who are actively involved in their finances lead to an improved overall quality of life. It goes without saying that you should save early and often. But if you are at a place in your life where you think your financial situation warrants a discussion, set up an appointment with me. If you are interested in some great infotainment, check out my YouTube channel and get to know how I approach finance. Reference 1. 2023 401(k) Participant Study Gen Z Focus Congratulations on receiving a refund this year and considering using it to pay down debt. There are key factors at play that may not be correlated with our current interest rate-sensitive environment. Lately, the FOMC has been evaluating dropping interest rates, and that can affect loans that have variable interest rates, such as credit cards. Let’s identify your situation and move forward with the best option for you.

First, are you behind on any payments? If so, it's in your best interest to pay those now so that your credit history isn't negatively impacted. However, if you're not behind and you have a plan in place to pay them down, it might not be in your best interest. It's probably not what you'd expect to hear, but instead of evaluating your debt through the lens of interest rates or balances, evaluate it through your behavioral spending. If you notice at the end of the year that the balances on that debt are growing instead of shrinking, you should put your money towards the account that is the "easiest win" or would make the most impact on your everyday life. That could mean getting rid of a balance or reducing interest. This mindset shift begins to establish that you are not defined by your debt and that you can overcome it. In a perfect scenario, you'd pay down debt with the highest fixed interest rate. Variable interest rates during a time of interest rate cuts are not the top priority, but they are during interest rate increases, as we've seen over the last two years. Next, pay down account balances, taking on small wins before tackling larger ones. The last thing you should pay down is lifetime debt. I would have a hard time justifying paying that down at this time since you could potentially earn more money in the market. A balance of taking care of your future and improving your current situation needs to be struck. Debt mindset varies for each person, but with the right tools and guidance to make informed decisions, you can leave some on the table and plan for a better future. I highlighted company-sponsored funds for utilizing target-date retirement funds and hindering the growth of your portfolio. While that strategy is not suitable for everyone because it lacks diversification, it raises the question: How can we create a diverse portfolio without sacrificing performance?

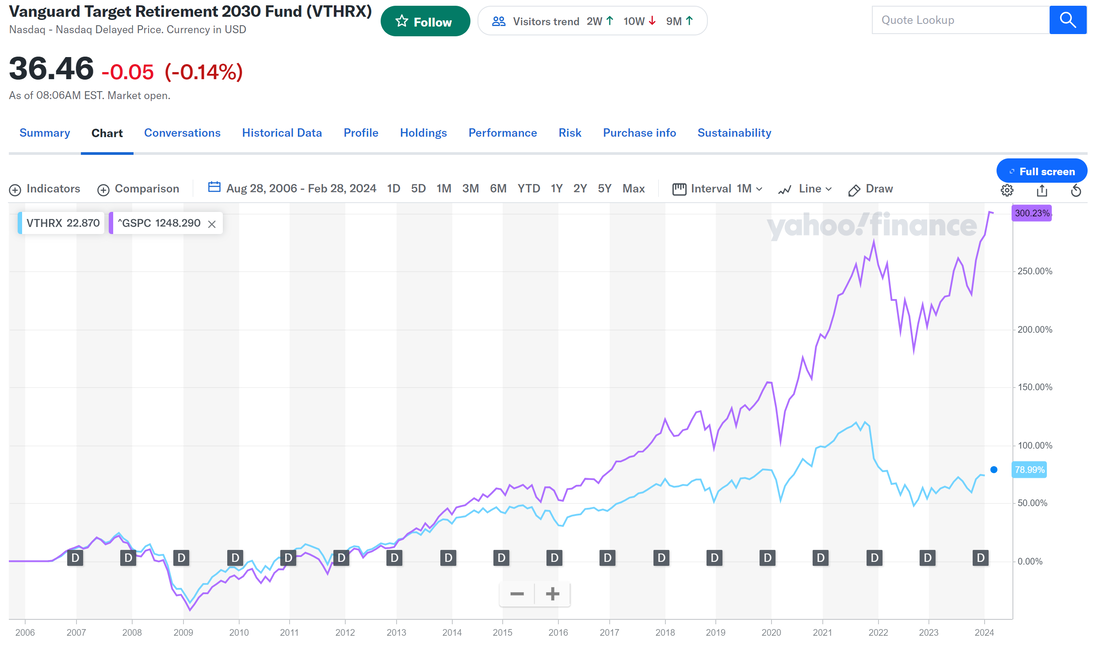

First, we need to identify the types of tools used for investing because they might be more diversified than you think. The most commonly used items are stocks, bonds, mutual funds, and Exchange-Traded Funds (ETFs). Stocks represent units of ownership in a company, offering upside potential and dividends. Bonds are units of debt in a company or government, paying interest over a set period and ensuring the value of your original investment. Mutual funds and ETFs are pooled investments that may include up to 500 various companies, aligned with an investing strategy or index. Traditionally, when building a portfolio before the emergence of mutual funds and ETFs, investors would choose uncorrelated companies to offset portfolio drawdowns. Conventional practice involved holding 20-30 positions. Nowadays, robo-advisors commonly employ model portfolios of 10-12 ETFs or mutual funds. However, the issue arises with over-diversification. For example, VOO, probably the most widely used ETF for robo-advisors, encompasses 500 companies. With a portfolio of 10-12 ETFs, you could end up holding positions in 6000 companies. To put this in perspective, the NYSE lists 8,000 securities available for trading. Diversification can mitigate portfolio drawdowns, but as the great Warren Buffet once said, "Diversification is protection against ignorance." If you lack the time to construct a portfolio and evaluate performance, seeking assistance from a professional is advisable. This can be achieved through a flat fee model or a percentage of accounts under management. There is no foolproof method to avoid drawdowns in a portfolio through diversification. Investing entails various risks: market, interest rate, or currency. Identifying your investing goals and devising a strategy to align with them is crucial to ensuring the suitability of your portfolio. Comparing your performance to others without considering their comfort level compared to yours is like comparing apples and penguins—it's illogical. Stop setting Millennials and Gen Z up for investment failure; here's how to get more out of your 401k. Company-sponsored investment plans, commonly known as 401k, serve as the initial investment tool for most Millennials and Gen Z. If you haven't purchased a house yet, they could represent the primary source of your net worth. These sleeping giants are supposed to form the foundation for retirement, but many younger investors are being shortchanged. The issue lies in automatic investments in target-date retirement funds. What are target-date retirement funds? Target-date retirement funds consist of a pre-selected mix of stocks and bonds based on your planned retirement date. They typically include four groups: US Equities, International, US Bonds, and International Bonds. For instance, if you have 40 years until retirement, your target-date fund might allocate 90% to stocks and 10% to bonds. As you approach your retirement date, the allocation shifts, aiming for a balance of 60% stocks and 40% bonds. The idea is that, closer to retirement, a more conservative approach is adopted, with bonds serving as a less volatile investment option. However, for the past several years, bonds and developed international equities have consistently underperformed, resulting in diminished upside potential. Based on the information below, if you had started your job in 2006 and invested in a target-date retirement fund, you would have incurred a loss of 215%. In no way is this a diverse portfolio; we will look further into this in Part 2, 'When Does a Diverse Portfolio Matter?' If you are using this as your benchmark, you are not meeting your goal and may be pushing back your retirement date even further.

What should you do? Align your investment goals with a benchmark. Within your 401k, there are options for Large Cap Equity, Mid Cap Equity, Small Cap Equity, and International investments. Research these options, considering their costs, potential upside, and how well they align with your retirement goals and timeframe. Mark your calendar to regularly re-evaluate performance. While it's easy in theory, putting it into practice can be challenging; the better you are at creating and sticking to a schedule, the more you'll see your portfolio grow. Hot tips: While you might be locked into changing your previous allocations for 60-90 days, future contributions can always be adjusted. Set your calendar for 2-3 days before your pay period, so changes will take effect for upcoming paychecks. If you notice a market decline, leave it in a stable value fund and allocate it to the next payroll. None of this will come naturally, but over time you'll become familiar with the platform you're using. And, as always, feel free to come to me with questions. Helping those just entering the workforce invest like a pro is one of my favorite things. Do you hold more cash than the average person? Let's explore strategies for maximizing wealth specifically tailored for “rich” individuals or accredited investors. I will break down an ideal guideline across your checking, savings, and emergency funds, while also providing insights on enhancing returns from other investment avenues.

Typically, individuals inclined towards saving fall into two categories: liquid savers, representing the everyday person, and long-term savers, characterizing the “rich”. Liquid savers prefer readily available funds, often held in checking, savings, high-yield (HY), or certificates of deposit (CDs) accounts. In contrast, long-term savers recognize that keeping cash in the bank is a depreciating asset. They maintain minimal account balances and seek tax-advantaged options to grow their savings, investing above the current inflation rate. How much should you maintain in your liquid accounts? A useful guideline is to have twice the average monthly spending in your checking, an additional month's spending in your savings, and for those with emergency funds, six months of income in a high-yield savings account. While CDs may not be as favorable as HY savings accounts, a potential shift into CDs could be considered if the Federal Reserve decreases interest rates. Assuming contributions to company-sponsored retirement accounts, Health Savings Accounts (HSAs), and Roth's are maximized, attention should shift to after-tax accounts, preferably those with tax advantages. Insurance-based options, such as annuities or universal life insurance, present themselves, but eligibility is contingent on health qualifications. For accredited investors seeking alternative options, exploring Regulation D offerings is advisable. These private placements adhere to FINRA guidelines, governing solicitation, issuance, and fundraising limits. Unregistered and non-public, these securities, like stocks or promissory notes, diversify portfolios beyond market conditions. Due diligence is crucial, requiring a longer process compared to registered securities. Tax implications vary by investment type and merit consultation with a tax professional. An example is Yrefy, a promissory note offering up to 10.25% on a 5-year fixed-income product.* Engaging with a knowledgeable investment advisor who understands your goals is integral in adopting a wealth-building strategy inline with “rich” individuals. Reference 1. Yrefy Fact Sheet Many of my fellow millennials are projected to undertake an average of five trips this year. Not only are we surpassing our generational counterparts in the frequency of vacations, but we are also managing to spend an average of $1,000 to $2,000 less in the process. This data is derived from a 2019 survey. In light of the escalating costs of airfare and the evolving landscape of vacation rentals, the question arises: how can anyone sustain such a lifestyle? Let's start with addressing budgetary concerns and tackling accommodation strategies.

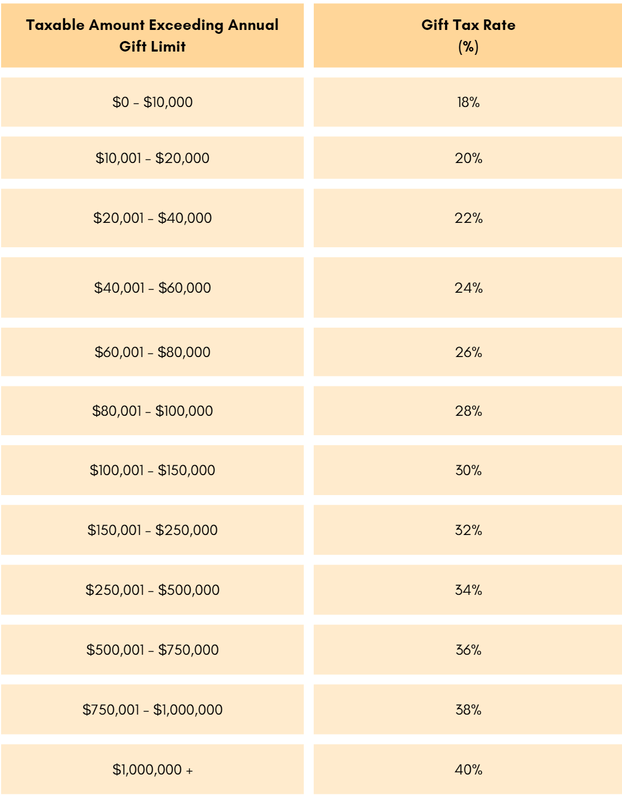

While not always the most enjoyable task, it is imperative to comprehend both income and expenditures. This year, the primary concern for my clients revolved around their spending habits in 2023 and the unanticipated costs that ensued. Having been a long-time user of Mint, I've transitioned to Credit Karma now. Although their services are complimentary, the majority of the dashboard comprises third-party marketing. Monarch stands out as a commendable solution, offering monthly reports and household overviews. With your data consolidated, it's time to streamline your financial commitments. Prioritizing minimalism and functionality becomes crucial, especially when spending extended periods away from home. Subscription services prove to be the easiest to cut, redirecting those funds to a savings account. Additionally, reassessing insurance, phone plans, internet expenses, and storage facilities could potentially result in savings of up to $400 per month. One significant factor, often overlooked but capable of contributing an extra $10,000 annually to your pocket, is scrutinizing grocery and dining expenses. A weekly night out in the downtown area can easily accumulate to $100 for one person – equivalent to the cost of a domestic round-trip ticket each month. Adopting a strategic approach, such as maximizing the use of your freezer to minimize waste and shopping for the month to curb impulse purchases, can be effective. When it comes to travel, accommodations and dining represent the most substantial costs. I strongly recommend exploring destinations that offer an authentic travel experience. As we bring our son along on our journeys, frequent dining out can become costly. Hence, we opt for trips where we can indulge, such as an all-inclusive package or a once-in-a-lifetime experience. Otherwise, we seek accommodations with kitchen facilities and proximity to a grocery store. In our recent trip to Belize, sharing sunrise moments with my son daily meant more to me than frequenting restaurants. Our travel revolves around quality time and immersion in new cultures. Distinguish between what you observe and what truly enriches your soul, and journey on with purpose. Every December, I make it a point to discuss matters related to charitable giving and gifting, and this year is no different. While there are numerous opportunities to contribute, it's crucial to consider tax efficiency, especially given the adjustments to the Annual Gift Tax Exclusion and Lifetime Gift Exclusion. Before exploring the specifics of these increases, let's first clarify the distinction between the Annual Gift Tax Exclusion and the Lifetime Gift Exclusion. The Annual Gift Tax sets the threshold for how much you can give before needing to complete Form 709. Any excess beyond this limit falls into the Lifetime Gift Exclusion, representing the maximum amount you can give before reporting the federal gift tax. It's important to note that the donor is responsible for paying the tax, and typically, these contributions are not tax-deductible unless they are charitable. Once the lifetime gift exclusion is exhausted, the federal tax on additional gifts may range from 18% to 40% if the contributions exceed the annual limit per donee. It's like navigating a gift-giving journey with a few tax signposts along the way! Federal Gift Tax Rates In 2023, the Annual Gift Tax Exclusion stood at $17,000 per donee, and next year, in 2024, it will see a bump to $18,000 per donee. Meanwhile, the Lifetime Gift Exclusion, which was $12.92 million in 2023, is set to rise to $13.61 million in 2024. Staying informed about these figures is crucial, but navigating the complex landscape of gift taxation demands the expertise of a professional tax advisor, especially considering the potential expiration of the lifetime gift exclusion post-2025 due to temporary changes in the Tax Cuts and Jobs Act 2017. It's worth noting that gifts take various forms, and only direct transfers to your spouse, medical providers, tuition/education, and gifts to political organizations qualify as exclusions. Crafting the optimal tax strategy for your giving requires careful planning, as we always say, if you fail to plan, you plan to fail. References

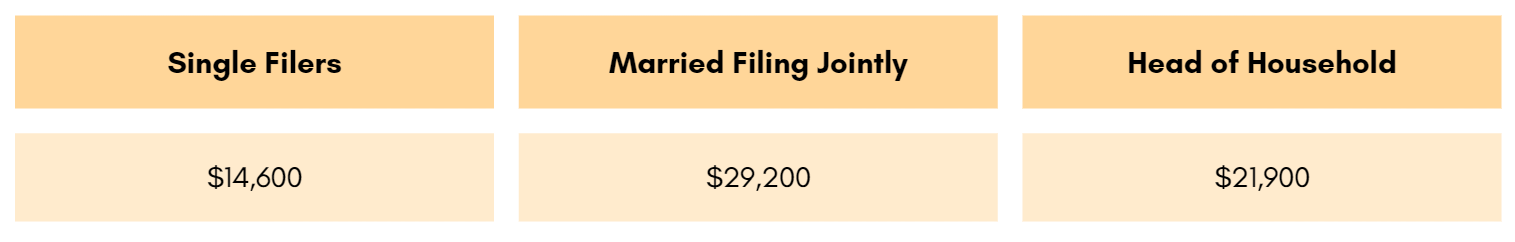

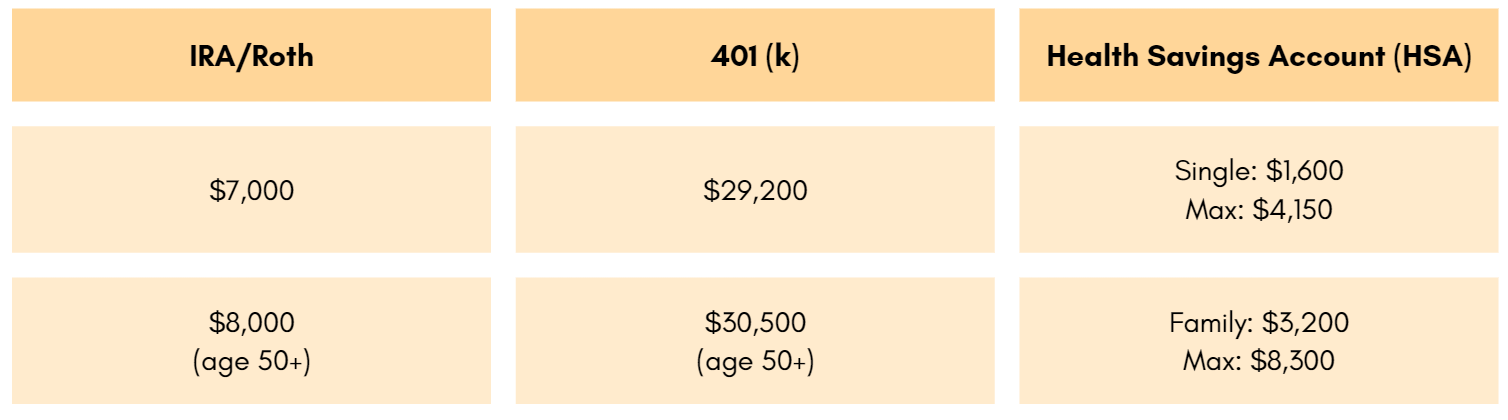

In October of each year, taxpayers typically anticipate the release of the IRS tax bands for each bracket. However, this year, the eagerly awaited information was not released until November 9th. It's crucial to distinguish between brackets and bands, with the former being a result of the 2017 Tax Cuts and Jobs Act. The current brackets stand at 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Notably, these brackets are slated to expire at the close of 2025, at which point the previous tax brackets are expected to take effect, with rates of 10%, 15%, 25%, 28%, 33%, 35%, and 39.7%, unless congressional intervention occurs. Unlike brackets, tax bands undergo annual adjustments to account for inflation and reflect changes in income for the respective year. Now, let's review some of the modifications currently in place. Deductions Every filing status comes with a standard deduction, complemented by additional deductions available for use in the upcoming tax year. For the current year, the inflation adjustments affecting the standard deduction and annual gifts are outlined below. As you can see, the annual exclusion for gifts is set to rise to $18,000 for the calendar year 2024. Contribution Limitations Leveraging retirement contributions presents a valuable opportunity to minimize your taxable liabilities, provided you meet the qualifying criteria. Notice the recent adjustments to IRA/Roth phase-out limits, now set at $123,000 to $143,000 for those filing jointly, and $77,000 to $87,000 for single filers. Strategically allocating funds towards retirement savings, coupled with a committed adherence to a budget, stands out as a strong approach to securing your financial success. Takeaways

Ensuring effective planning is key as you approach the upcoming year and here are some important takeaways:

In an ideal scenario, especially for those aged 50 and above with a family high-deductible health plan featuring a Health Savings Account (HSA), there's an opportunity to contribute up to $46,800 and potentially adjust your marginal tax rate by 10%. It's crucial to consult with a tax advisor to tailor a plan to your unique circumstances. These insights serve as tools for your discussions with them. Keep in mind, these approaches and methods are only a few ways in which I help families grow their savings. Collaborating with professionals ensures that your goals remain aligned and provides a comprehensive strategy for your financial success. |

Archives

July 2024

Categories |

Financial Services are offered through Family Retirement LLC, a registered investment advisor. Family Retirement LLC is a registered investment advisor in the State of Washington. Family Retirement LLC may not transact business in states where we are not appropriately registered, excluded, or exempted from registration. Individual responses to persons that involve either the effecting of transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions.

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

RSS Feed

RSS Feed