|

In 2023, the Federal Reserve revealed that generational wealth in the U.S. reached a staggering $140 trillion. What's interesting is that Baby Boomers account for just shy of half of that wealth. But here's the thing – this transfer of wealth doesn't have to wait until the time of death. Baby Boomers are well aware of the importance of future planning, especially in the face of discussions about new laws affecting high net worth and ultra high net worth individuals. So, the big question is how to make sure this wealth transition to your minor children goes off without a hitch.

When you're hashing out your legacy plans with your attorney, they'll probably recommend creating a trust for minors as part of the handover process. This is an excellent way to ensure that the wealth is transferred exactly as you intend it to be. You can strategize the allocation, plan preemptive distributions, and make sure the beneficiaries receive the funds as you intended. Beyond all the benefits of this approach, the main win here is that it helps you avoid probate and steer clear of the nightmare scenario of funds getting locked up in an account for the minor. Having dealt with a blocked account firsthand in Washington, it’s my opinion it's at the detriment of the child beneficiary. The court system steps in, assigns a case worker, evaluates the assets' division at the estate's expense, and then locks the funds in an account until the child reaches adulthood. These locked accounts have modest growth and typically sit in a basic savings account. If you want to steer clear of this mess, your options are to go through the hoops of becoming a guardian ad litem, appealing to the court for that role, and satisfying several financial responsibilities to gain the court's approval. It's a hassle, and to make matters more frustrating, finding a lawyer in Seattle to help with this process is no walk in the park. Now, there's another way to avoid the probate maze, and it's through beneficiary statements and transfer on death instructions. Depending on the type of account, this can be another fantastic option for minors. The key takeaway here is this: don't leave a financial puzzle for your heirs to sort through. Make sure your wealth transfer aligns with the best interests of the recipient. If you have any questions about wealth transfer or have recently come into an inheritance, give me a call. I'm here to help you piece together the most tax-efficient strategy possible.

0 Comments

Term life insurance stands out as one of the easiest insurance options to secure. Although there are various reasons people might hesitate to obtain it, cost tends to be a primary concern. While this may appear as a drawback, it's crucial to emphasize the significance of consulting an experienced agent and obtaining sufficient coverage. In a realm full of salespeople and rapid-fire quotes, the question arises: who can you truly rely on? While snagging a quote within 20 minutes or less might seem convenient, you could potentially compromise on coverage or miss out on special considerations. Such tools work wonders for individuals well-versed in insurance products and familiar with the nuances among them. However, if you haven't had that exposure, your best path could be engaging an independent insurance agent. Such an agent can offer choices from multiple companies, catering to your specific needs. When seeking out an independent agent, don't hesitate to inquire if they function as fiduciaries. This signifies their commitment to acting in your utmost interest. If they can't promptly affirm this commitment or if their response seems evasive, it's advisable to search for someone who unequivocally prioritizes your well-being. Another promising sign is if they openly disclose the commissions they earn for each product recommendation. This transparency indicates they remain uninfluenced by compensation. Term insurance constitutes a vital component of estate planning. Determining the appropriate coverage involves assessing factors such as debt settlement, one-time expenses for your beneficiaries, and supplementary income. To accomplish this, drafting a budget becomes necessary. Take into account all outstanding debts and potential future financial obligations. While the process might seem meticulous, enlisting the right expert can result in a comprehensive plan that provides vital support to your beneficiaries during the most challenging phase of their lives. As you delve deeper into the realm of insurance, comprehending the diverse benefits of various insurance products becomes essential. If you're interested in receiving quotes, don't hesitate to shoot me an email. Let's work together to identify the perfect fit for your needs. Resources

Most people plan their retirements around specific financial goals and timelines they set for themselves. However, retirement planning is truly a family affair. Every decision you make will impact not only your own future but also the lives of your family members and loved ones. Involving the whole family in the planning process is crucial for successful execution.

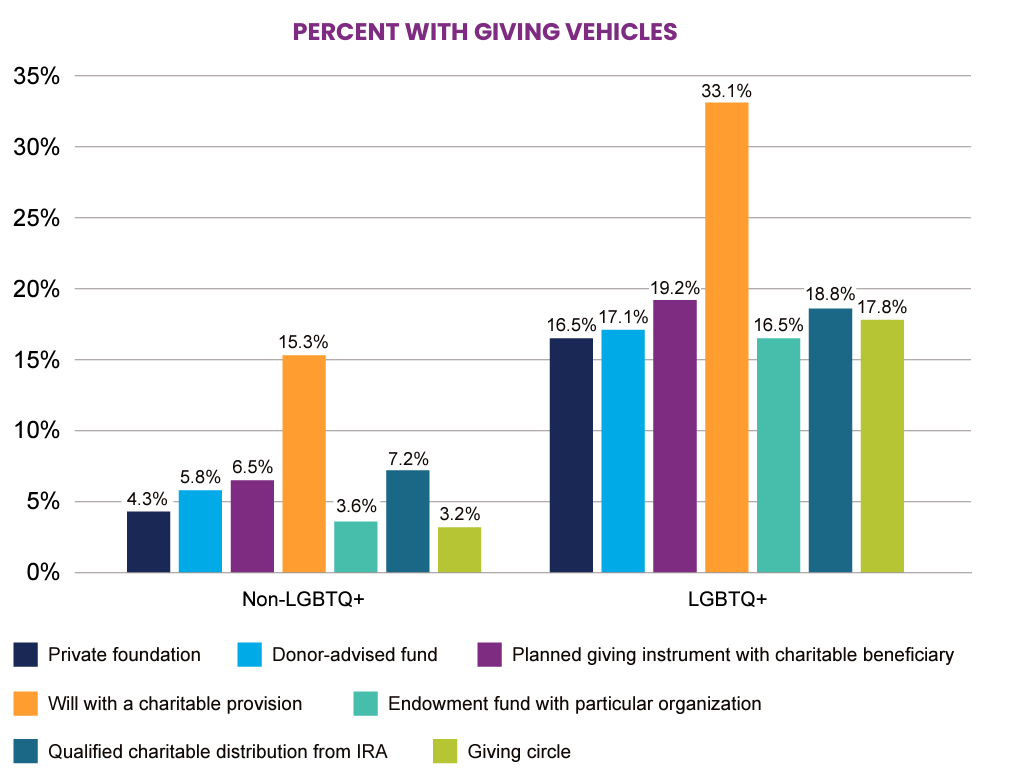

To begin, prioritize open communication and mutual support among family members. Determine the most effective ways to communicate both emotionally and practically. This could involve regular family meetings or seeking guidance from a financial advisor to facilitate discussions. Next, discuss your collective aspirations for the future and identify areas where your family's goals align. While many retirees have a desire to travel and explore the world, it's common for them to also prioritize staying close to family, especially grandchildren, as they age. By understanding what truly matters to you, you can shape your goals accordingly. Once you have established effective communication and identified shared aspirations, focus on the lifestyle adjustments required to meet your needs. Consider how your daily routines may change, particularly for those who plan to travel extensively. Many retirees take up new hobbies, engage in volunteer work, or pursue part-time employment to maintain a fulfilling and purposeful lifestyle. Discuss the necessary lifestyle adjustments to ensure success. Another crucial aspect is addressing the topic of longevity. Planning for a longer retirement becomes increasingly relevant as life expectancies rise. It is now common for older parents to move in with their children, and there are even instances where children are financially compensated for caring for sick and aging family members. Discuss the possibility of a longer life and ensure you have the financial resources and family support to accommodate it. Remember that retirement planning is a dynamic process. While these points serve as a starting point, regular reassessment and adjustments are necessary. Above all, prioritize effective communication, as it not only facilitates the planning process but also ensures that each family member's voice is heard. If you require further information or assistance, feel free to schedule a meeting with me today using the link below. In the vibrant tapestry of human diversity, the LGBTQ+ community stands as a beacon of resilience, courage, and pride. As this community continues to strive for equal rights and recognition, it is crucial to shed light on the unique financial challenges they face. From wage gaps and employment discrimination to the complex intricacies of family planning and retirement, the financial landscape for queer individuals demands attention and understanding. This article delves into some of the unique considerations in retirement planning and how to better prepare for the future. Family Needs Yes, everyone has different needs but when you are a member of the LGBTQ+ community the journey towards expanding your family entails heightened financial obligations from the outset. When you evaluate the available options: in vitro fertilization (IVF), surrogacy, or adoption, the cost associated can be well over $60,000. Expanding your family comes with not only financial implications but also emotional ramifications. Families opting for adoption often experience prolonged periods of emotional turbulence and uncertainty in their journey with the child they have welcomed into their lives, enduring months or even years of back-and-forth interactions. Understanding the best options for withdrawals could save you from paying undue taxes. Elderly Care When considering long-term care alternatives, the challenges encountered by LGBTQ+ individuals extend beyond the fundamental facility requirements. Some factors of consideration include ensuring the facility and caretakers have aligned values, as well as meeting their financial limitations. Historically, the LGBTQ+ community has been impacted by HIV and AIDS. While treatment advances have come a long way, immunocompromised individuals are more likely to require home care. The LBGTQ+ community is 2-3 times more likely to live independently due to the premium cost of specialized care. Legacy Planning In a 2021 Bank of America Philanthropy Study: Charitable Giving by Affluent Households, affluent LGBTQ+ households were more likely to contain multiple different charitable vehicles and give at a higher rate than their non-LGBTQ+ households. The variety of vehicles used for their charitable organization are intentional through the utilization of donor advised funds and charitable distributions from an IRA. When a legacy plan is carefully curated it is mutually beneficial to the owner and charity. Affluent LGBTQ+ Americans Prioritize Making an Impact Source: Bank of America. “2021 Bank of America Study of Philanthropy: Charitable Giving by Affluent Households.” September 29, 2021 Beyond the glittering surface of progress, many members of the LGBTQ+ community encounter formidable financial hurdles that impact their livelihoods and long-term stability. We want to help smooth these barriers out. When looking for a financial advisor, on top of all the other qualifications, you want to make sure that the individual honors pronouns, doesn’t lump you into the group of their clients, and provides you with the comfort of a plan best suited for your needs and journey. Book an appointment below to see if we are the right fit for you. Resources

As Father’s day approaches, I think of my dad and all the wonderful life lessons he taught me - like how to throw a football, change spark plugs, and evaluate if something is a need or a want. Some of these lessons don’t have much impact now but it does spark the conversation on teaching finances to our children. Depending on your child and your family’s comfort level with finance, you may approach these pillars at different times. This topic is not meant to be a 15-minute TedTalk but instead should be a lifelong discussion that evolves as they grow. Tackling the Basics: If you get money where does it go? Early on (2-3 years old) when our son would get money, we decided to put three containers in front of him labeled: savings, spending, and giving. Our son didn’t need to know the main objectives behind each category, the point was to involve him in the decision making process. We would celebrate it all the same. As he got older (5-6 years old) and the containers were a little heavier, we set up bank accounts for each of these containers. Instead of putting them all in the same bank, we separated the savings account into a high yield bank and put his spending/giving accounts with a bank that was easy to access. I like this for a couple reasons. First, it breaks the stigma of needing to hold all your money at one institution because you’ve been a customer for a while. Second, when you divide it up between banks it puts the significance on the purpose of the funds therefore aligning to what is best suited for your needs. Around this same time we introduced a new rule, you can put as much as you like in spending BUT you need to match it in savings. A simple change that helps him understand the value of money and how he shouldn’t spend outside his means. One day he proudly came up to us and wanted to use his money to buy a gift for a friend. Out of all the categories the giving tends to be the hardest for kids to understand. This simple choice shows he is comfortable with his savings and doesn’t feel the need to spend money on himself because his needs are met. At this point he demonstrates an understanding of how each category works and it’s time to move to the next opportunity, investing. Investing 101: When do you introduce investing? Coincidentally, the Roblox IPO was available which provided several learning opportunities. Roblox has an internal currency called “Robux and he understood that he could purchase “Robux '' to buy things within the game. He connected with the idea - if he bought Roblox instead of Robux his money has the potential to grow without doing more chores. Of course these are not exactly the same but it was similar enough to peak his interest. He purchased Roblox with his own money. At the end of each month, we would say “it's time to look at how much your Roblox has made”. Then I would ask him, “are more people buying or more people selling?” This review helped him understand the highs and lows of investing. In fact, one day when he came home from school, I was preparing his birthday and I said I have good news! His reaction was priceless "Did my Roblox stock go up?” He is still showing interest, so we proceed to share more knowledge. As he gets older, we will look at more visually based tools that allow him to research his investments and compare them to the S&P. As he grasps these concepts more, we discuss how long to hold those investments and when is the best time to move to another investment. Just like anything with kids you need to establish a program, set up a routine, and encourage questions. Before you set up an account for your child make sure to understand the difference in account types by reading my 3-part series, Better than Basics: Level Up Your Financial Literacy, or book an appointment with me below. Teaching our next generation about finance is our opportunity to build a strong foundation early on and ensure financial independence for their future. If you fail to plan, you plan to fail.

Nowadays, women and investing is becoming a hotter topic. Sites like Dow Janes and Ellevest target their marketing towards women as their investing needs and goals for retirement do not conform to the traditional path. For example, I’ve seen men do some of the riskiest things with their lives and those habits inevitably lead to shorter longevity. Therefore, women often focus more on longevity since they tend to outlive men. While evaluating their portfolios, women will want to pay attention to these three behaviors to avoid letting returns slip away. Lower Contributions In Vanguard's, How American Saves Study, it shows that women participate in their 401k contributions more than their male counterparts; however, they are saving at a lower rate. Oftentimes these savings rates increase as the women become higher income earners. Some other factors for lower contributions and account balances involve women entering the workforce later in life and women often start at the entry level positions and work their way up. Between the lower rate of savings and the wage gap - currently 82 cents per every dollar a man earns - it’s even harder for women to save for a lengthy retirement. Lower Risk Tolerance Men and women differ in many ways when it comes to their risk tolerance. For instance, men take more risk when investing. To determine your risk tolerance, complete an investor profile. An investor profile is based on several different factors: risk tolerance, financial goals, and time horizon. Time horizon is arguably one of the most important factors to creating your investor profile. If this is a roadmap to retirement, think of the time horizon as the destination and the speed is your risk tolerance. Another consideration when analyzing the lower risk tolerance of women is evaluating the downside potential. Many investors focus on how much they can make and the potential loss. Since women make less on average, the thought of losing their hard earned money is not worth the high risk. Analysis Paralysis Let’s assume you are able to contribute at a greater rate and you have a higher risk tolerance. Then the only thing standing in the way is research and execution. Research is not much of an issue for female investors, the concern is execution. Execution can be stunted in a variety of ways: trying to time the market, imposter syndrome, or they are just plain too busy. Unfortunately, these three behaviors create a trifecta for lower returns and most women are repeat offenders. It’s not with malicious intent that women do it but instead it’s from natural programming with the instinct to protect. This protection resonates differently amongst women but it starts with their association with money. To take a closer look at that, sit down with me and make your investments a priority. If you fail to plan, you plan to fail.

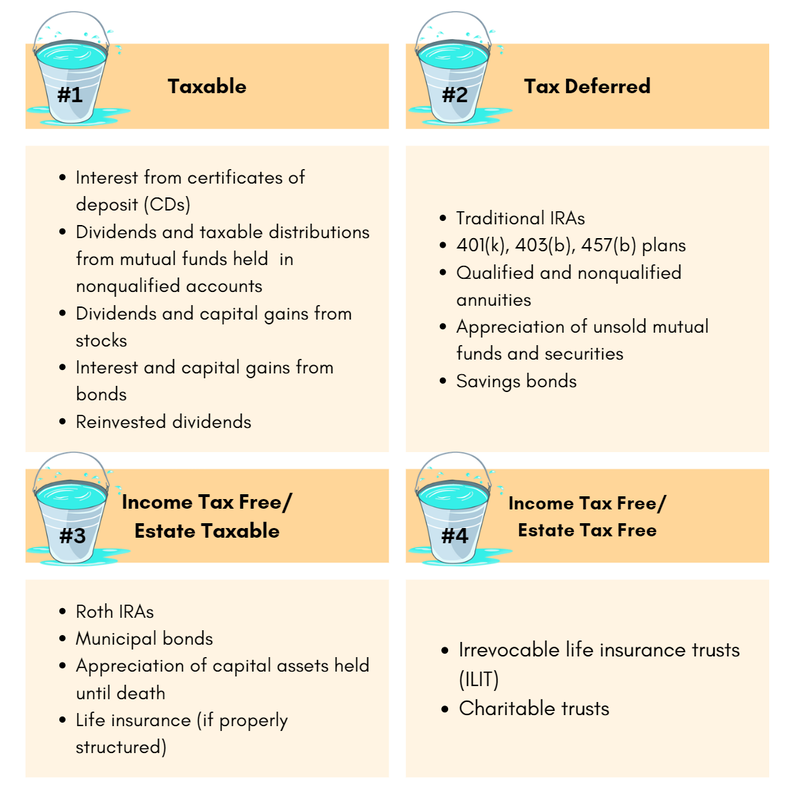

Over the past few weeks you can take what we’ve learned and compare it against your career path. Part one of our series focuses on individuals just starting their first jobs and are overwhelmed with the constant inflow of information. Part two is when you’ve had a couple of years to digest the information and want to invest more productively. The last and third part of our series is aimed toward those individuals who are ready to start withdrawing from these accounts. As we explained in part two, tax liabilities for each account varies and withdrawing from them can negatively impact your tax situation. For example, some investors will withdraw funds from their brokerage account to make larger purchases (i.e., home, car, etc.) but if the investments are held less than 12 months there are tax implications. Even more, if you are looking to pull money from a retirement account the amount is restricted and is only for first-time homebuyers - this is unless you are willing to take an additional penalty on top of the ordinary income. The Bucket System One traditional method for withdrawing money is called the bucket system. This strategy is based on the philosophy that over time you’ll receive more income as you age and this is partly due to earnings from social security and required minimum distributions. This system breaks up account types into taxable, tax deferred, and tax free. Each of these tax liabilities were discussed in Part two of our series. Most investors will begin withdrawing from Bucket 1: Taxable accounts to subsidize their income as they age. After depleting the funds from Bucket 1, you’ll ideally move to Bucket 2: Tax Deferred withdrawals. In some cases - like required minimum distributions (RMD) - you would need to take a distribution prior to the depletion of your taxable funds (e.g., bucket 1). After that point, you can offset your RMD and reduce the amount taken from Bucket 1. If you have disbursed everything from your first and second bucket, you’ll move on to the Bucket 3:Tax Free which will have the most favorable tax treatment. In the example below, you will see there is a fourth bucket which is specific to reducing your estate’s taxable liability after you’ve passed. We haven’t discussed much about this but in our life insurance series later this year we’ll dive into this strategy. This system is not fool proof and depending on your financial situation a second opinion can save you money that others would have left on the table. I work with individuals to help create plans around their financial goals and offer guidance on how to take advantage of the opportunities within their portfolio. For a personalized plan, schedule an appointment with me today and to learn more about Strategies for Retirement use the download button below for a FREE pamphlet. If you fail to plan, you plan to fail.

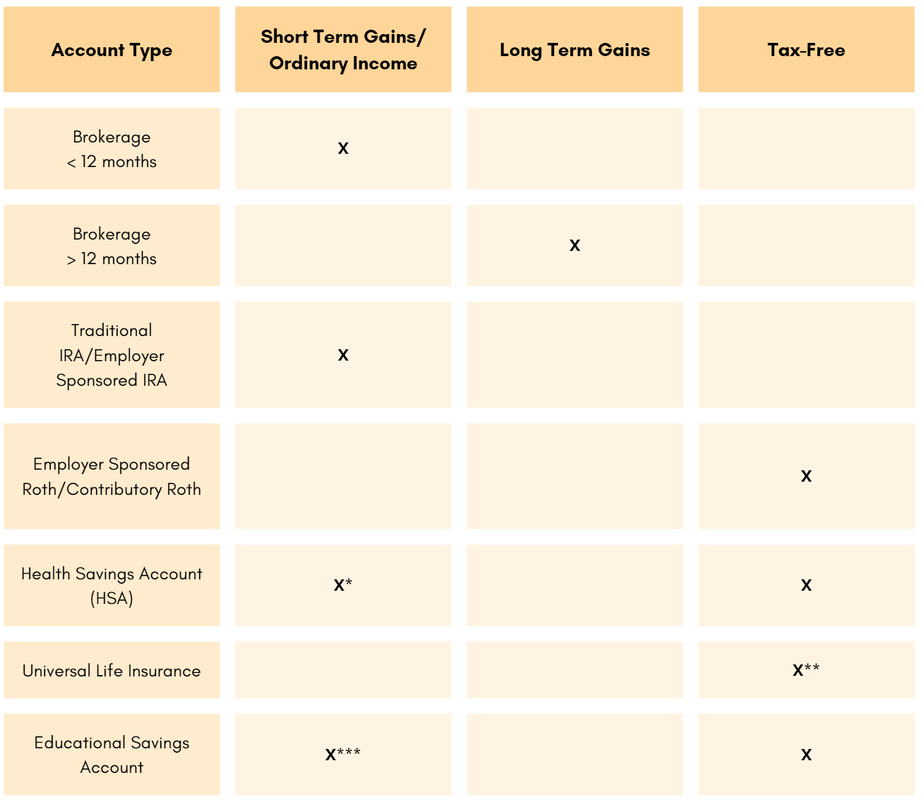

In Part One of our series, we discussed how knowing the basics of financial literacy is helpful but it’s not enough. Oftentimes the losses are simple misunderstandings about the taxation of different investing accounts. To start leveling up your literacy, we associated some common account types and their typical tax classifications. Now, it’s time to kick it up a notch! In Part Two, you’ll learn about short versus long term gains, ordinary income tax rates, and calculating profit. Short Term Capital Gains /(Ordinary Income Tax Rate) Simply put, short term capital gains are the profit on an investment that is held for less than 12 months. These gains are taxed at the same rate as your ordinary income. Your ordinary income rate is based on your filing status and your taxable income. It’s important to know that tax brackets are established annually and marginal - this means that rates change annually and the marginal tax rate is tiered. Long Term Capital Gains Long term capital gains are the profit on an investment that has been held for 12 months or longer. The taxation on the profit is broken down into three tiers based on your filing status and federal income. These tiers will change annually depending on taxable income. Non-Taxable or Tax-Free Out of the three taxation methods, this type is my favorite because the profits and the income from these funds are not subject to taxation. However, there are also many scenarios where you can lose tax free status. So, make sure to consult a tax professional before making updates in your account and to help you get a better understanding of those restrictions. Calculating Profit Since you have a good understanding of taxation methods, let’s take a few seconds to create the profit calculation. Profit is the difference between the purchase price and the sell price. The purchase price can be found on your investment statements and is called “cost basis”. Subtract the purchase price from the selling price to get your profit. Calculating Capital Gains Taxation will depend on 2 factors: current tax rate and type of gain short/long. If it’s short, you add your ordinary income and be taxed at the end of year income. If it’s long you need to find your tax rate and then the corresponding long term capital gains rate. The profit will be taxed at that rate. You may notice that only brokerage accounts track this because they are not tax advantaged - unlike your retirement accounts. As we wrap up this series, I want to reiterate the different tax triggers for each account. Brokerage accounts are triggered by the sales of positions in the portfolio and not by a withdrawal from your account. Pre-tax retirement accounts are always taxed at the ordinary income rates. Lastly, Roth accounts are tax-free assuming no restrictions apply. Remember to discuss these decisions with a tax professional. Having a better understanding of taxation rates for accounts leads perfectly into our next topic. We'll conclude this series by learning to properly structure withdrawal from these account types to limit your tax liability and improve your financial outlook. If you fail to plan, you plan to fail.

Becoming familiar with the basics of financial literacy - budgeting, investing, and personal finance - helps most Americans create plans to achieve their financial goals. However, financial literacy goes beyond the basics. In fact, a 2020 survey found that the majority of surveyors lost approximately $1600 due to lack of understanding - in the U.S that’s a loss of over 415 billion dollars. So it begs the question, how do investors stop leaving money on the table? If you’ve already laid the foundation with the basics, the next big opportunity is within your tax liabilities. Tax liabilities are simply the taxes you will pay to the government though our focus is taxes that occur while investing. More specifically, we take time to review taxation on various account types, the “gold standard” for withdrawing funds, and how/when penalties are triggered. Account Review To understand different tax liabilities, the first thing we review is account type. Each investment account has distinct tax liabilities which are in the form of short and long term capital gains, ordinary income, and tax-free. The amount taxed will depend on the account type, investment time frame, and income, as well as some other factors. Below are some common account types and typical taxation methods. *When funds are used for non-medical expenses under age 65 and 20% additional penalty. **When taken as a loan. ***Non-qualified and 10% penalty. As you can see, the chart is not as straightforward as it seems. There are exceptions and instances where you can find yourself with higher tax liabilities for failure to understand the restrictions. There are even cases where accounts can lose their tax advantaged status. Each situation is unique and there isn’t a “one size fits all” solution. If you need some assistance or want to learn more, simply schedule a meeting using the link below. Be on the lookout for Part 2, where we’ll break down taxation rates and review consequences. In the final part 3 of our series, we’ll wrap up on when to take money out of each account to minimize your tax liability. If you fail to plan, you plan to fail.

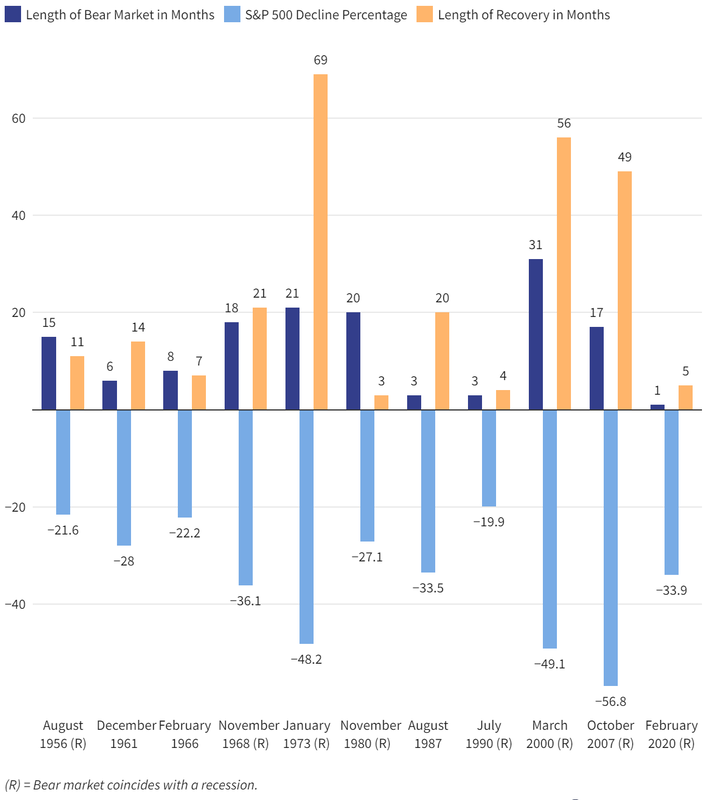

When investors rebalance their portfolios, the influence of their decisions is usually determined by media outlet research. If you’ve been listening to most news sources then you are hearing recession, recession, recession. But, if you are looking at the data and trying to find a way back into the market: here are some tips you’ll want to review. When do you know it’s the bottom? Many people associate a bear market with a recession. A recession is typically defined as 2 consecutive quarters of negative gross domestic product (GDP). However, a bear market is a drop from the peak to the bottom of greater than 20%. Our peak was December of 2021 (S&P 4766.18) and our most recent bottom is October of 2022 (S&P 3583.07). While this may not be the bottom, an average bear market is 9-13 months. Since our recent low, markets have been bouncing around influenced by the latest interest rate increases and other economic data point decreases. S&P 500 Bear Markets and Recoveries How can you invest? After you’ve evaluated where the market stands you can move in two different directions. The first is the path to recovery and the other is expansion. The path to recovery means we may have some turbulent times ahead but investing in sectors that have lower beta than the S&P should limit the drawdown your portfolio is exposed to. Common investment sectors include utilities, consumer staples, healthcare, and real estate. Keep in mind, this strategy doesn’t guarantee against loss but it creates an inverse reaction to the general stock market. If you are under the impression that we are likely to move towards expansion, you’ll be looking for options that have a higher beta than the S&P (e.g., greater than 1.0). These are not guaranteed to produce a gain and are subject to more volatility. Sectors you’ll commonly see aligned with those portfolios are energy, consumer discretionary, financial, and technology. Stepping away from sector focused investing another traditional train of thought is to move more money into bonds but with the rising interest rates. Though, it might be best to table that for a little while. You’ll also notice that the best performing indices might not be the Dow or S&P, and in many cases have been NASDAQ and Russell. Having the right balance between market knowledge and understanding your investment style is imperative to making sure your portfolio is meeting your goals. Book your appointment below and take the first step to put a plan in place. If you fail to plan, you plan to fail.

|

Archives

July 2024

Categories |

Financial Services are offered through Family Retirement LLC, a registered investment advisor. Family Retirement LLC is a registered investment advisor in the State of Washington. Family Retirement LLC may not transact business in states where we are not appropriately registered, excluded, or exempted from registration. Individual responses to persons that involve either the effecting of transactions in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions.

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

Privacy Policy | ADV Part2A

425-610-9226

1700 Westlake Avenue North Suite 200

Seattle, WA 98109

Copyright © 2024

RSS Feed

RSS Feed